![]() To specify the Calculation Mode click on the Calculation Mode button or Press Alt+M. The below given form will open up where the user can specify the calculation for the sale rate. Select the field name from the list and then specify whether it should be implemented on Basic Rate, Cumulative or after the specific position. Specify the default value and If the account is not mentioned then everything will be implemented on the default Tax heads.

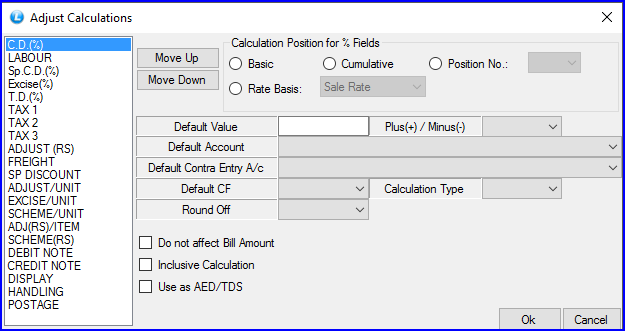

To specify the Calculation Mode click on the Calculation Mode button or Press Alt+M. The below given form will open up where the user can specify the calculation for the sale rate. Select the field name from the list and then specify whether it should be implemented on Basic Rate, Cumulative or after the specific position. Specify the default value and If the account is not mentioned then everything will be implemented on the default Tax heads.

Fig 1. Adjust Calculations

![]() Move Up: To move a field higher up in the order select the field to be moved up and then click on Move Up button or Press Alt+U. Click on Save button or Press Alt+S to save the settings.

Move Up: To move a field higher up in the order select the field to be moved up and then click on Move Up button or Press Alt+U. Click on Save button or Press Alt+S to save the settings.

![]() Move Down: To move a field lower down in the order select the field to be moved down and then click on Move Down button or Press Alt+D. Click on Save button or Press Alt+S to save the settings.

Move Down: To move a field lower down in the order select the field to be moved down and then click on Move Down button or Press Alt+D. Click on Save button or Press Alt+S to save the settings.

![]() Calculation Positions: Select the field name from the list and then specify whether it should be implemented on Basic Rate, Cumulative or after the specific position.

Calculation Positions: Select the field name from the list and then specify whether it should be implemented on Basic Rate, Cumulative or after the specific position.

For Ex- Rs 100 is a basic rate and then 2% CD is applied to it, then Rs 98 would be cumulative rate and if we set the calculation field as Cumulative for labour then the labour will be calculated in Rs 98.

![]() Default Value: Specify the default value, whether this amount should be added or subtracted and if this particular thing should be implemented for a particular Account or not.

Default Value: Specify the default value, whether this amount should be added or subtracted and if this particular thing should be implemented for a particular Account or not.

![]() Default Account: Specify the default account and If the Account is not mentioned then everything will be implemented on the default Tax heads.

Default Account: Specify the default account and If the Account is not mentioned then everything will be implemented on the default Tax heads.

![]() Do not affect bill amount: If user don't want any affect in bill amount for the selected field then select this option.

Do not affect bill amount: If user don't want any affect in bill amount for the selected field then select this option.

![]() Inclusive Calculation

Inclusive Calculation

![]() Use as AED/TDS

Use as AED/TDS