![]() When you click on create new account, a new window appears on your screen.

When you click on create new account, a new window appears on your screen.

![]() Now, you can enter GST fields like GST Date and GST No. while creating new account of the customer. See the window below:

Now, you can enter GST fields like GST Date and GST No. while creating new account of the customer. See the window below:

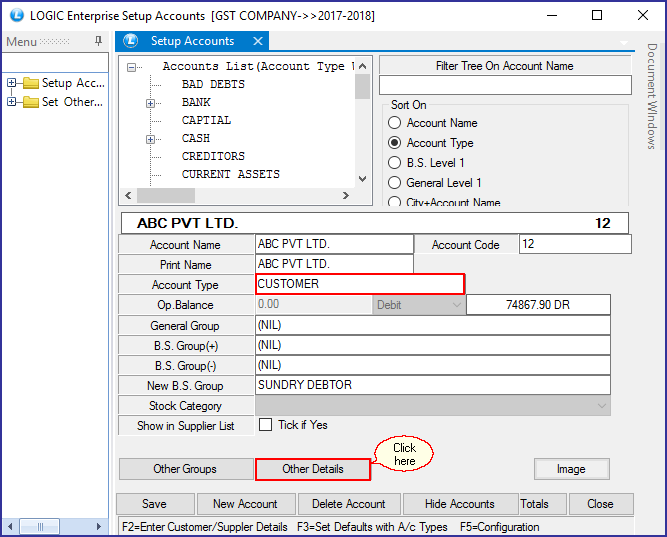

Account Type: Customer

![]() Create an account under account type Customer, click on Other Details.

Create an account under account type Customer, click on Other Details.

Fig 1. Setup New Account (Customer)

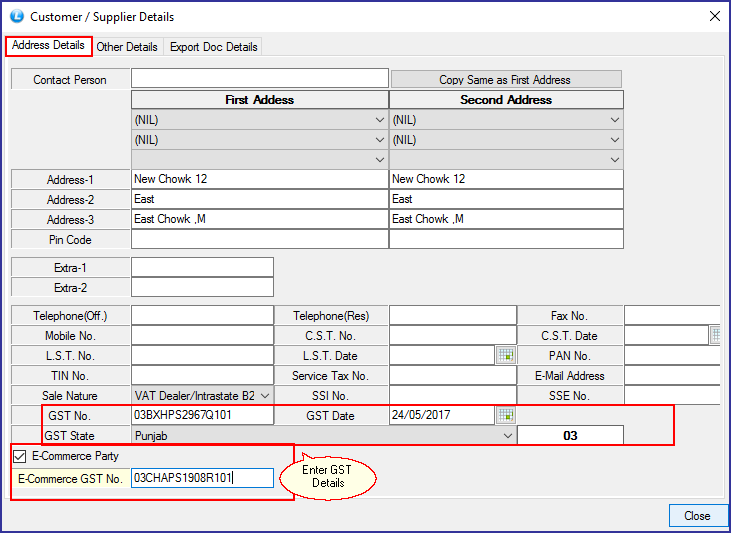

![]() A new window will appear on your screen, Click on Address Details Tab. Here, you can enter GST details of account type: Customer.

A new window will appear on your screen, Click on Address Details Tab. Here, you can enter GST details of account type: Customer.

Fig 2. Customer Supplier Details

![]() Check E- Commerce Party box to enable entering E-Commerce GST No. Enter GST No., GST Date and GST State from drop-down and press enter.

Check E- Commerce Party box to enable entering E-Commerce GST No. Enter GST No., GST Date and GST State from drop-down and press enter.

![]() Enter details and close the window.

Enter details and close the window.

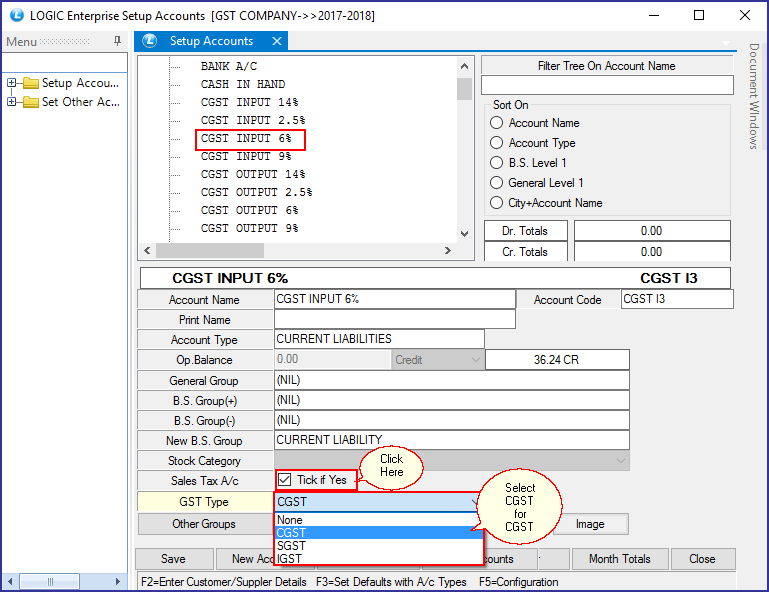

Account Type: Current Assets and Current Liabilities

Creating CGST Account:

![]() When you create an account under account type Current Assets or Current Liabilities, click on Sales Tax A/c. If you check this box, it will enable GST Type option. You can select GST group for the responding account.

When you create an account under account type Current Assets or Current Liabilities, click on Sales Tax A/c. If you check this box, it will enable GST Type option. You can select GST group for the responding account.

Fig 3. Setup New Account (Current Liabilities)- CGST

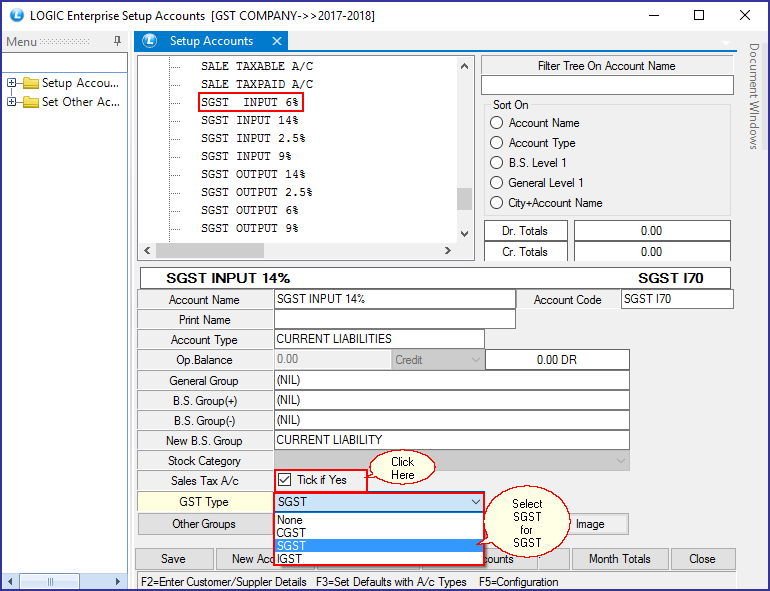

Creating SGST Account:

![]() When you create an account under account type Current Assets or Current Liabilities, click on Sales Tax A/c. If you check this box, it will enable GST Type option. You can select VAT group for the responding account.

When you create an account under account type Current Assets or Current Liabilities, click on Sales Tax A/c. If you check this box, it will enable GST Type option. You can select VAT group for the responding account.

Fig 4. Setup New Account (Current Liabilities)- SGST

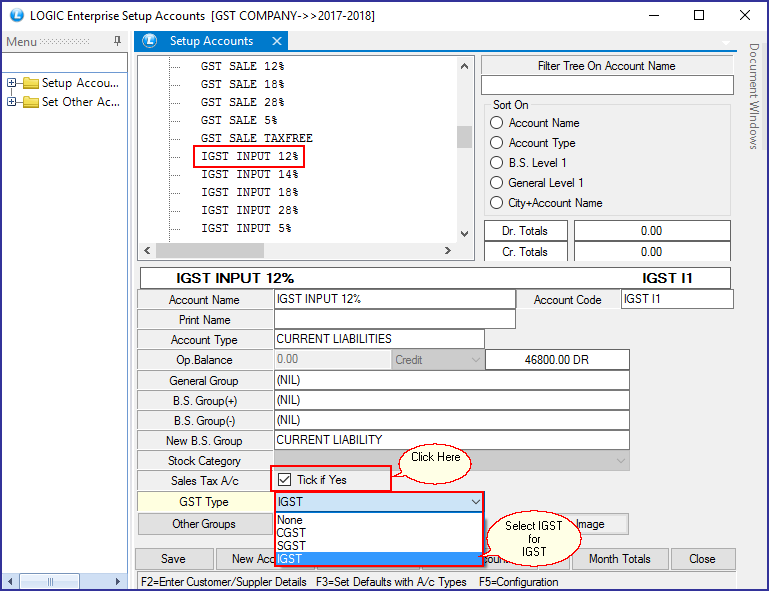

IGST:

![]() When you create an account under account type Current Assets or Current Liabilities, click on Sales Tax A/c. If you check this box, it will enable GST Type option. You can select VAT group for the responding account.

When you create an account under account type Current Assets or Current Liabilities, click on Sales Tax A/c. If you check this box, it will enable GST Type option. You can select VAT group for the responding account.

Fig 5. Setup New Account (Current Liabilities)- IGST

|

Selecting Sales Tax A/c is mandatory to enable GST Type option. |

|

If your are creating an account for CGST, choose GST Type CGST as well . Similarly, IGST group for IGST account and SGST group for SGST account. |