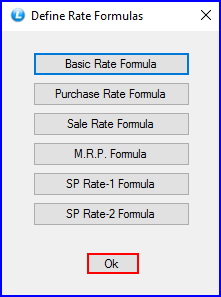

The user can define following rate formulas with he help of this form-

![]() Basic Rate Formula- Basic rate of the item will be calculated by this option.

Basic Rate Formula- Basic rate of the item will be calculated by this option.

![]() Purchase Rate Formula- Purchase rate of the item will be calculated by this option.

Purchase Rate Formula- Purchase rate of the item will be calculated by this option.

![]() Sale Rate Formula- Sale rate of the item will be calculated by this option.

Sale Rate Formula- Sale rate of the item will be calculated by this option.

![]() M.R.P Formula- M.R.P of the item will be calculated by this option.

M.R.P Formula- M.R.P of the item will be calculated by this option.

![]() SP Rate-1 Formula- Special rate-1 of the item will be calculated by this option.

SP Rate-1 Formula- Special rate-1 of the item will be calculated by this option.

![]() SP Rate-2 Formula- Special rate-2 of the item will be calculated by this option

SP Rate-2 Formula- Special rate-2 of the item will be calculated by this option

Fig 1. Define Rate Formulas

![]() The user can specify how the Purchase Rate has to be calculated for the items. For this go to Other Settings-1 in Configuration. The next step will be to go to the Define Rate Formulas and click on Purchase Rate Formula button.

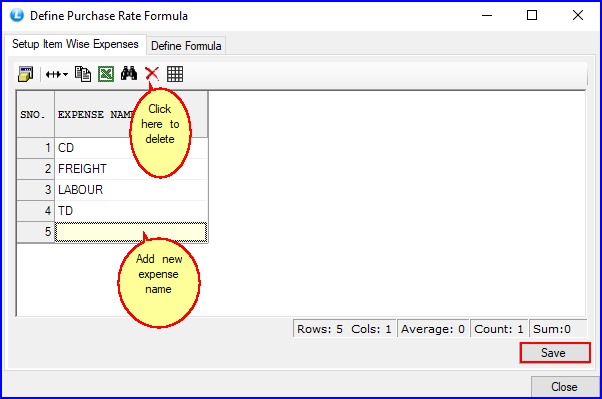

The user can specify how the Purchase Rate has to be calculated for the items. For this go to Other Settings-1 in Configuration. The next step will be to go to the Define Rate Formulas and click on Purchase Rate Formula button.

![]() The Define Purchase Rate Formula form will open up where the user will first have to create the Expense type for the Purchase Rate Formula.

The Define Purchase Rate Formula form will open up where the user will first have to create the Expense type for the Purchase Rate Formula.

![]() Define Purchase Rate Formula is a must to calculate the figure of Purchase Rate.

Define Purchase Rate Formula is a must to calculate the figure of Purchase Rate.

Fig 2. Define Purchase Rate Formula

Fig 3. Define Purchase Rate Formula

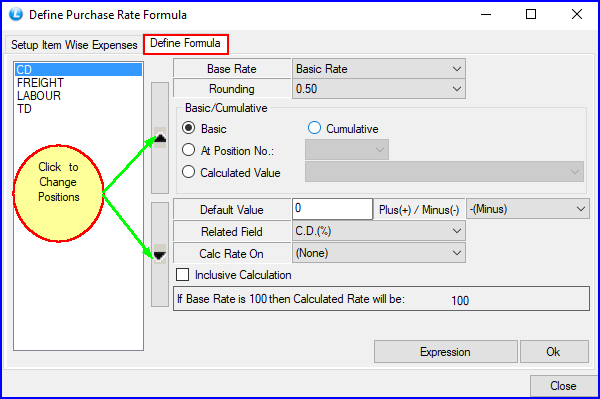

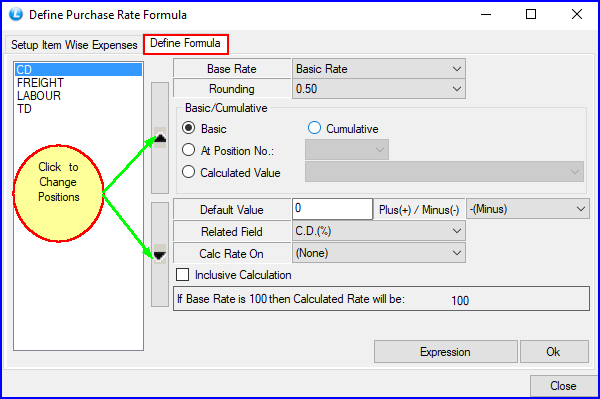

![]() After creating expense type, then comes the step to set the values for the fields and specify the formula for the Purchase Rate.

After creating expense type, then comes the step to set the values for the fields and specify the formula for the Purchase Rate.

![]() Base rate is an important factor as this decides how the rest of the figures are calculated and hence in a way decides the final values. Rounding will decide the range of how much amount you can round up.

Base rate is an important factor as this decides how the rest of the figures are calculated and hence in a way decides the final values. Rounding will decide the range of how much amount you can round up.

For example:- 282.45 can rounded to 282 because of the 0.50 Rounding shown in the window of Define Purchase Rate Formula.

![]() Default Value if kept at more than 0 then that will become the default percentage for any Expense item you set it for. This will mean that Related Field will be kept at (None) and hence the subsequent Purchase Voucher bills will deduct CD, TD etc from the Default Value user will decide.

Default Value if kept at more than 0 then that will become the default percentage for any Expense item you set it for. This will mean that Related Field will be kept at (None) and hence the subsequent Purchase Voucher bills will deduct CD, TD etc from the Default Value user will decide.

![]() Calculate Rate on will be kept at None for all the expense items.

Calculate Rate on will be kept at None for all the expense items.

![]() Update Rates from Formula before Saving: It is necessary to select this option so that updated rates from Formula could be saved.

Update Rates from Formula before Saving: It is necessary to select this option so that updated rates from Formula could be saved.

![]() Lets illustrate a few expense items as following:

Lets illustrate a few expense items as following:

1.CD

2. TD

3. Freight

4. Labour

1. CD (Cash Discount) :-

Related Field has to be CD % and CD is subtracted from the Basic Rate.

Fig 4. Define Purchase Rate Formula

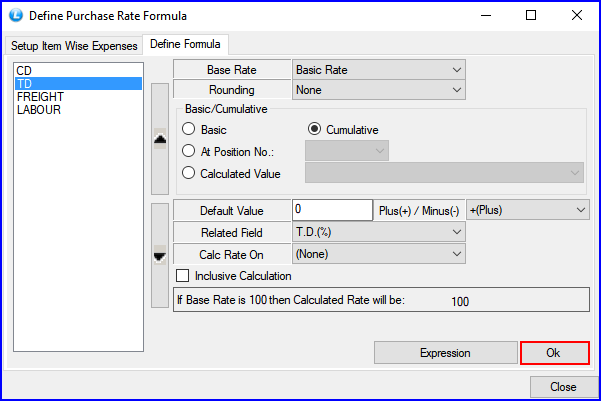

2. TD (Trade Discount) :-

Related field will be TD % and TD is subtracted from the Basic Rate. TD uses Cumulative Rate to subtract TD and what that means is that TD will be subtracted from the value we get after CD% is subtracted from Basic Rate. TD will not be subtracted from Basic Rate.

Fig 5. Define Purchase Rate Formula

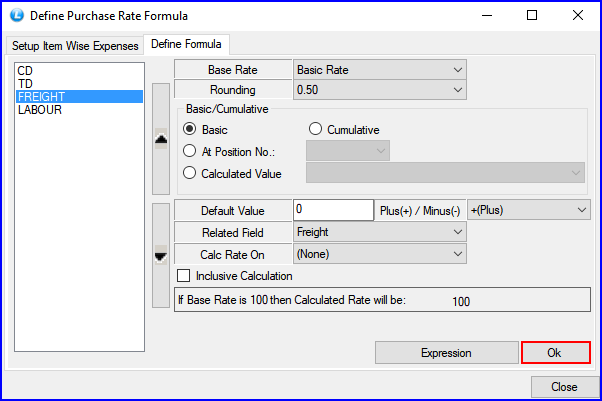

3. Freight :-

Freight is added to the whole bill and not just every unit like most of the other expense items on the list. Related field will be Freight.

Fig 6. Define Purchase Rate Formula

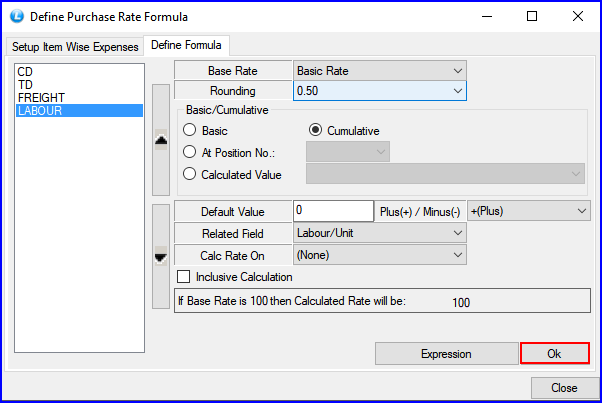

4. Labour:-

Labour is added to every unit of the bill and Related Field will be Labour/Unit.

Fig 7. Define Purchase Rate Formula

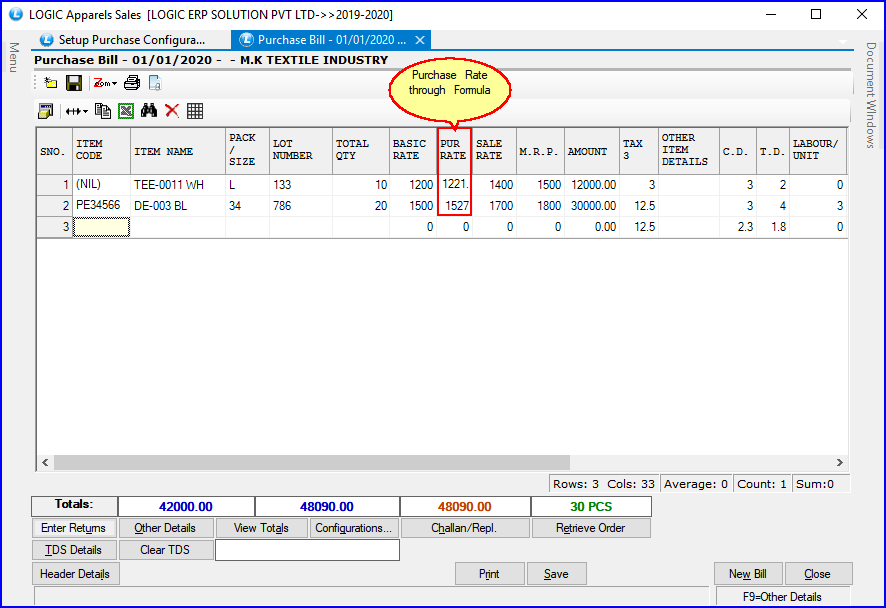

![]() Once the user has gone through all the steps of Purchase Rate Formulas then its time to proceed to Purchase Voucher to see the effect.

Once the user has gone through all the steps of Purchase Rate Formulas then its time to proceed to Purchase Voucher to see the effect.

Fig 8. Purchase Bill

How to Calculate Purchase Rate:-

![]() Let us illustrate with the above seen example how to achieve the above seen figure through the formula. Important thing to keep in mind is the calculation will depend on Basic Rate. Let's start with the important figures to be kept in mind while doing the calculation.

Let us illustrate with the above seen example how to achieve the above seen figure through the formula. Important thing to keep in mind is the calculation will depend on Basic Rate. Let's start with the important figures to be kept in mind while doing the calculation.

![]() Freight (Which will be added to the whole bill) is Rs. 300 (In this case).

Freight (Which will be added to the whole bill) is Rs. 300 (In this case).

![]() Labour (Which is added per unit of every item) is Rs. 3 (In this case).

Labour (Which is added per unit of every item) is Rs. 3 (In this case).

![]() Total Quantity here for both items i.e TEE-0011 LE & DE-003 BL is 10 and 20 respectively in this case.

Total Quantity here for both items i.e TEE-0011 LE & DE-003 BL is 10 and 20 respectively in this case.

![]() Basic Rate Per Unit for Items is Rs. 1200 and Rs. 1500 respectively in this bill. So to begin with let's start with subtracting CD % and then subtracting TD % from that value as TD is Cumulative . Then add Labour to that value.

Basic Rate Per Unit for Items is Rs. 1200 and Rs. 1500 respectively in this bill. So to begin with let's start with subtracting CD % and then subtracting TD % from that value as TD is Cumulative . Then add Labour to that value.

![]() 1500 (Basic Rate) - 30 ( CD 2%) = 1470 - 44.1 (TD 3%) =1425.9 + 3 (Labour /Unit)= 1428.9

1500 (Basic Rate) - 30 ( CD 2%) = 1470 - 44.1 (TD 3%) =1425.9 + 3 (Labour /Unit)= 1428.9

![]() The second step will be to multiply Total Quantity with Basic Rate and add the result for both items. For example:- 10 (Total Qty) * 1200 (Basic Rate) + 20 (Total Qty) * 1500 (Basic Rate) = 42,000.

The second step will be to multiply Total Quantity with Basic Rate and add the result for both items. For example:- 10 (Total Qty) * 1200 (Basic Rate) + 20 (Total Qty) * 1500 (Basic Rate) = 42,000.

![]() Then just divide the Freight by the result of the previous step shown i.e 300 (Freight) ÷ 42,000 = 0.0071428571428571.

Then just divide the Freight by the result of the previous step shown i.e 300 (Freight) ÷ 42,000 = 0.0071428571428571.

![]() So now we take the figure of 1428.9 reached in the first step of calculation and multiply it with the figure reached with 300 (Freight) ÷ 42,000 = 10.20642857142857.

So now we take the figure of 1428.9 reached in the first step of calculation and multiply it with the figure reached with 300 (Freight) ÷ 42,000 = 10.20642857142857.

![]() 1428.9 + 10.20642857142857= 1,439.106428571429 which can be rounded off to 1439.5 being the figure of Purchase Rate as the formula set for Purchase Rate allows for .50 range of Rounding.

1428.9 + 10.20642857142857= 1,439.106428571429 which can be rounded off to 1439.5 being the figure of Purchase Rate as the formula set for Purchase Rate allows for .50 range of Rounding.

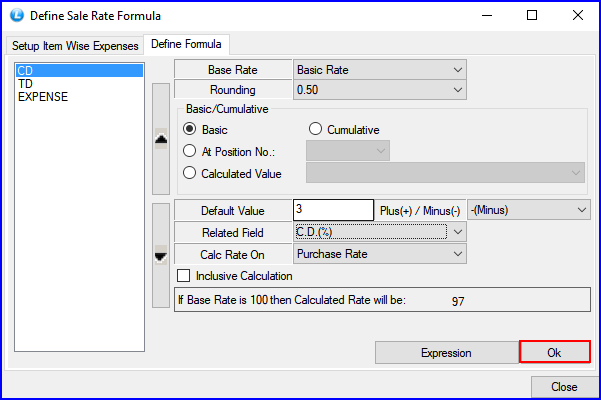

After creating expense type, then set the values for the fields and specify the formula for the Sale Rate.

Fig 9. Define Sale Rate Formula

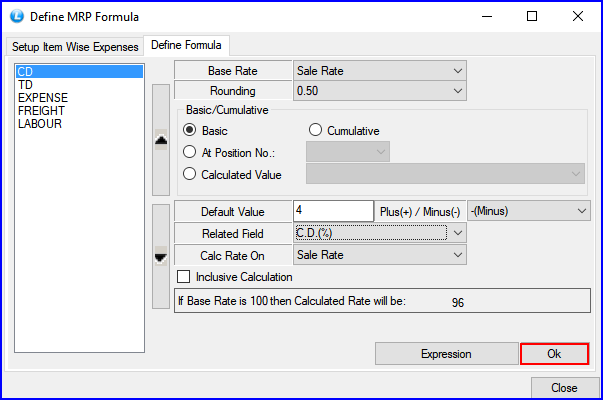

After creating expense type, then set the values for the fields and specify the formula for the M.R.P.

Fig 10. Define M.R.P Formula

Like this user can also specify special rate formula according to his requirement in SP Rate-1 Formula or SP Rate-2 Formula.