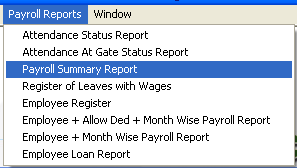

Employee Provident Fund Deduction : Follow the under mentioned steps :-

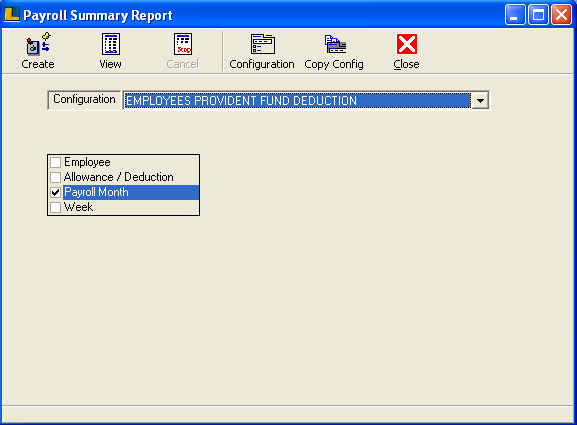

Enter the configuration name as Employee Provident Fund Deduction or select from the configuration list.

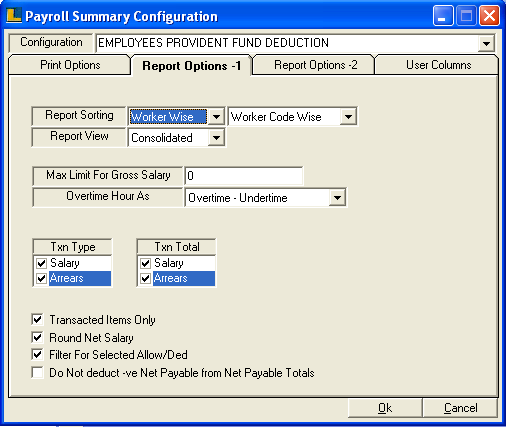

Select Report Options -1 and select Report Sorting as Worker Wise which can be department or group wise. Select the Report view as Consolidated.Select the Txn Types as per the requirements.

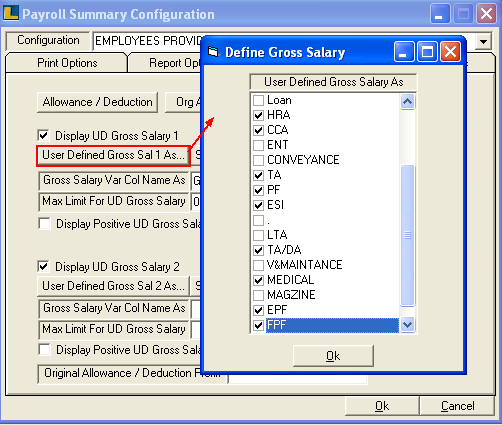

Click the Report Options -2 and define the User Define Gross Sal 1 as shown in the figure.

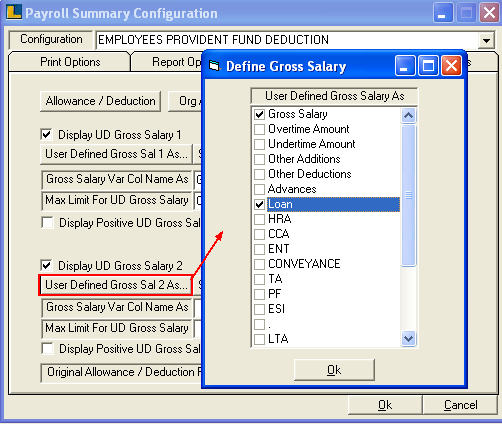

Click the Report Options -2 and define the User Define Gross Sal 2 as shown in the figure.

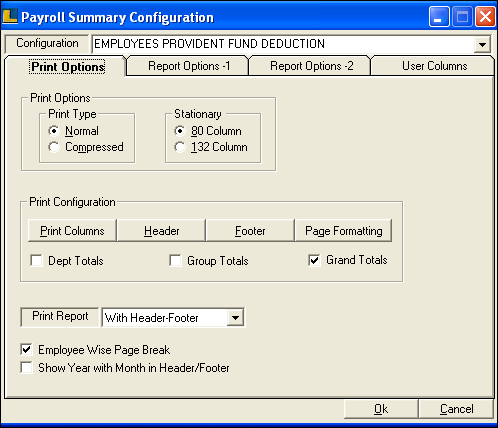

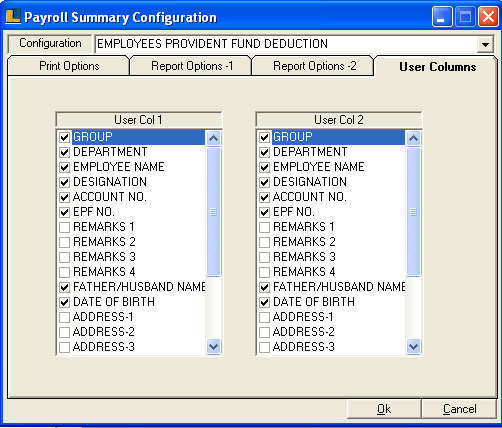

Click the User Columns option and select the columns according to the requirements. Click Ok and Save.

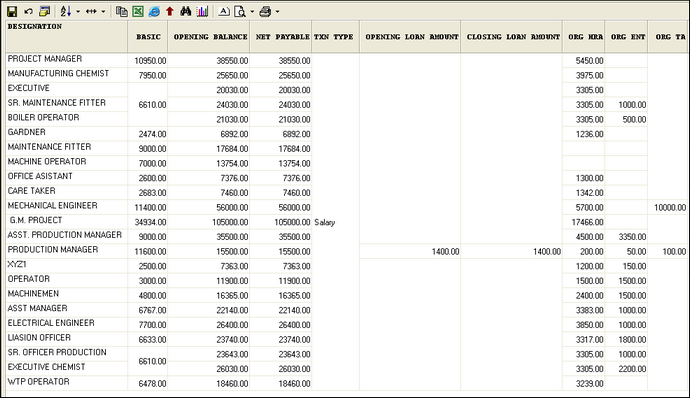

Click Create button or Press F2 to view the report.This report provides the details of the salary with deductions under EPF and the net amount.

|