| Show/Hide Hidden Text |

![]() This from allows the user to define the parameters related to taxes for the sale. These Tax Types will be available in Items with multiple (Company+Shade+Size) form.

This from allows the user to define the parameters related to taxes for the sale. These Tax Types will be available in Items with multiple (Company+Shade+Size) form.

![]() Setup Tax Type: Main Menu > Setup Taxes > Setup Tax Types (Sale).

Setup Tax Type: Main Menu > Setup Taxes > Setup Tax Types (Sale).

Fig 1. Main Menu |

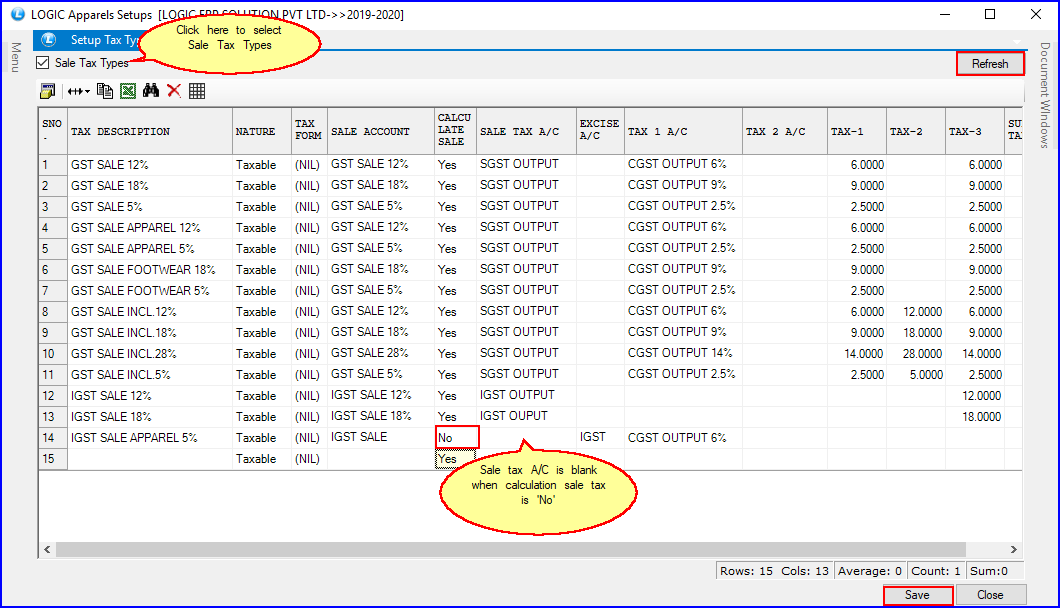

To Create the Tax Type (Sale) enter the Tax Description, Sale Account (these are the Accounts whose Account Type are set to Sale during the creation of Accounts through Setup New Account form), Calculate Sale Tax, Sale Tax Account (these are the Accounts whose Account Type are set to Current Liabilities during the creation of Accounts through Setup New Account form).

![]() Tax Description: User can provide Tax Description manually and it is mandatory. Tax Description is the tax type defined by user for ex - GST SALE TAX 12%, GST SALE TAX 18% etc.

Tax Description: User can provide Tax Description manually and it is mandatory. Tax Description is the tax type defined by user for ex - GST SALE TAX 12%, GST SALE TAX 18% etc.

![]() Nature: Select the nature of the tax type from the list. There are three kinds of nature : Tax Paid,Taxable,Tax Free. This option is used in Bill Printing to create separate columns on basis of Nature.

Nature: Select the nature of the tax type from the list. There are three kinds of nature : Tax Paid,Taxable,Tax Free. This option is used in Bill Printing to create separate columns on basis of Nature.

![]() Tax Form: Select the Tax Form for this tax type from the list. It is an optional column.

Tax Form: Select the Tax Form for this tax type from the list. It is an optional column.

![]() Sale Account: Select the Sale Account from the list.Sale Account is a account which holds the sale value of the product. It is a mandatory column can't be left blank.

Sale Account: Select the Sale Account from the list.Sale Account is a account which holds the sale value of the product. It is a mandatory column can't be left blank.

![]() Calculate Sales Tax: Specify whether the sale tax is calculated or not. Select Yes or No from the list.

Calculate Sales Tax: Specify whether the sale tax is calculated or not. Select Yes or No from the list.

![]() Sale Tax A/c: Select the Sale Tax A/c from the list. Sale Tax A/c is a account which holds the Sale Tax value of the product. The Sale Tax A/c is allocated only when we Calculate Sale Tax.

Sale Tax A/c: Select the Sale Tax A/c from the list. Sale Tax A/c is a account which holds the Sale Tax value of the product. The Sale Tax A/c is allocated only when we Calculate Sale Tax.

For example: If a product cost 100 and 5% is the sale tax then total cost is 105. Now the 100 amount goes in Sale Account and 5 goes under Sale Tax Account.

![]() Surcharge A/c: If Calculate Sales Tax is set to Yes, then specify the Surcharge Account. If the this field is not set, then we are not able to specify surcharge A/c.

Surcharge A/c: If Calculate Sales Tax is set to Yes, then specify the Surcharge Account. If the this field is not set, then we are not able to specify surcharge A/c.

![]() Excise A/c: Excise A/c is specified only when excise is charged on sale. This option will only work in case Tax 3 (Sale Tax) & Excise in the Bill are set to Bill Wise.

Excise A/c: Excise A/c is specified only when excise is charged on sale. This option will only work in case Tax 3 (Sale Tax) & Excise in the Bill are set to Bill Wise.

![]() Taxes: Enter the values for taxes manually. There are three Tax columns : Tax-1,Tax-2,Tax-3. User can specify the percentage values in these fields.

Taxes: Enter the values for taxes manually. There are three Tax columns : Tax-1,Tax-2,Tax-3. User can specify the percentage values in these fields.

![]() Tax 1 A/c: Specify Tax 1 Account in case any Tax 1 is charged in the Sale Bill. This option will only work in case Tax 3 (Sales Tax) and Tax 1 in the Bill are set to Bill Wise.

Tax 1 A/c: Specify Tax 1 Account in case any Tax 1 is charged in the Sale Bill. This option will only work in case Tax 3 (Sales Tax) and Tax 1 in the Bill are set to Bill Wise.

![]() Tax 2 A/c: Specify Tax 2 Account in case any Tax 2 is charged in the Sale Bill. This option will only work in case Tax 3 (Sales Tax) and Tax 2 in the Bill are set to Bill Wise.

Tax 2 A/c: Specify Tax 2 Account in case any Tax 2 is charged in the Sale Bill. This option will only work in case Tax 3 (Sales Tax) and Tax 2 in the Bill are set to Bill Wise.

![]() Tax-3: It is used for CGST/SGST.

Tax-3: It is used for CGST/SGST.

After all the records has been entered click on Save button Or Press Alt + S to save all the record that has been entered.Click Close button or press Alt+C to exit.

Fig 2. Setup Tax Types (Sale)

|

To save the data entered by the user, user have to press enter button and the cursor should be on next line in the grid. |

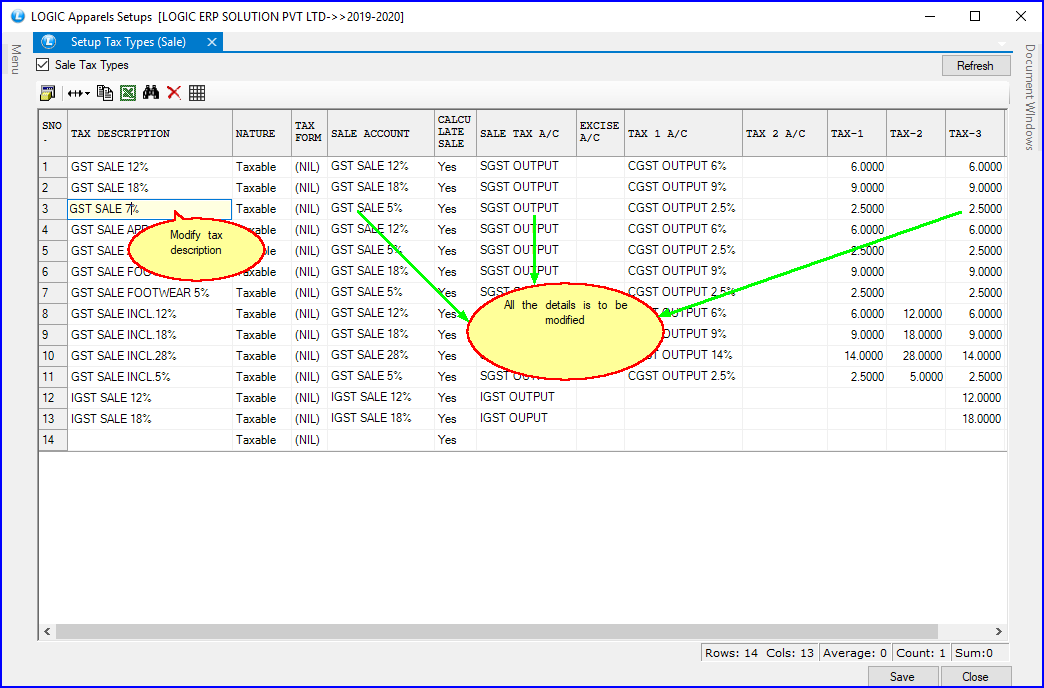

To Modify the Tax Type(Sale) select the Tax Type to be modified, make the necessary changes and then click on Next button or Press Alt+N so that the changes are visible in the grid. Then click on Save button or Press Alt+S to save the changes that have been made.

Fig 3. Setup Tax Types (Sale)

|

Once the Tax Type is created by the user then it cannot be Deleted. |