| Show/Hide Hidden Text |

![]() TDS means Tax Deducted at Source. The concept of TDS was introduced in the Income Tax Act in 1961, with the objective of deducting the tax on an income, at the source of income. It is one of the methods of collecting Income Tax, which ensures regular flow of income to the Government.

TDS means Tax Deducted at Source. The concept of TDS was introduced in the Income Tax Act in 1961, with the objective of deducting the tax on an income, at the source of income. It is one of the methods of collecting Income Tax, which ensures regular flow of income to the Government.

![]() The tax so dedeucted at source by the payer has to be deposited in the governmnet treasury to the credit of central governmnet within the specified time.

The tax so dedeucted at source by the payer has to be deposited in the governmnet treasury to the credit of central governmnet within the specified time.

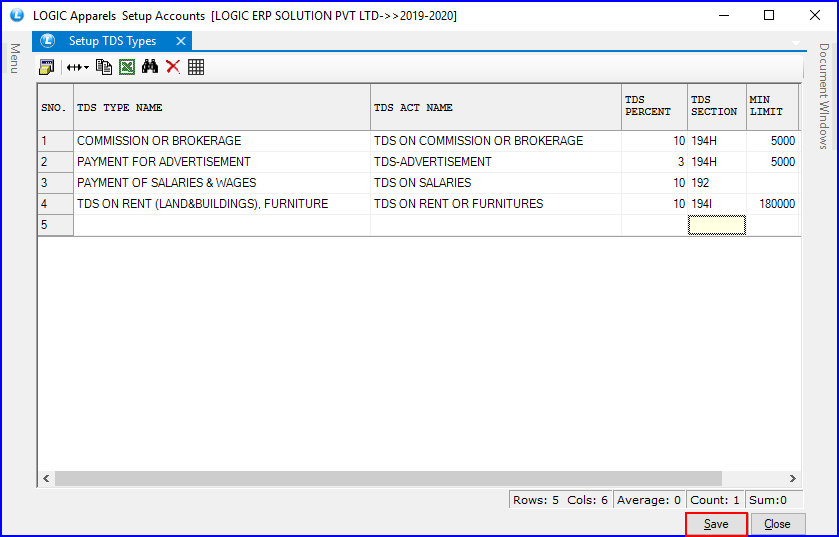

![]() TDS Creation: Main Menu > Setup Accounts > Setup TDS Types.

TDS Creation: Main Menu > Setup Accounts > Setup TDS Types.

Fig 1. Main Menu |

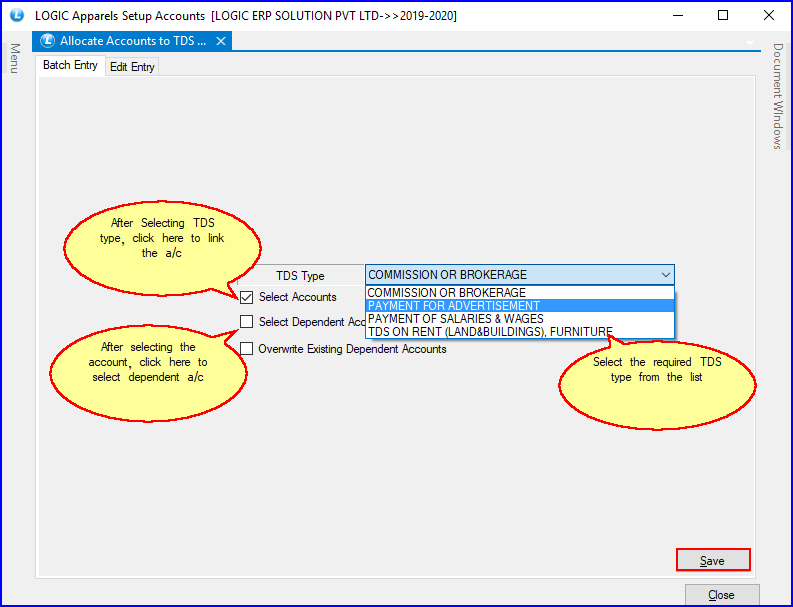

![]() Allocate Accounts To TDS Types

Allocate Accounts To TDS Types

![]() Recording Basic TDS Transactions

Recording Basic TDS Transactions

To account the TDS transaction follow the steps given below:

Step-1 :

![]() Creating Masters- User can create ledger for the accounts in Account\Ledger Creation form.

Creating Masters- User can create ledger for the accounts in Account\Ledger Creation form.

| 1. | Expense Ledger (For Example- We have made an expense ledger named as Advertisement Expense). |

| 2. | Party Ledger (For Example- We have made a party edger named as Vishal Mega Mart). |

| 3. | TDS Ledger (For Example- We have made a TDS ledger named as TDS-Advertisement). |

| 4. | Bank Ledger (For Example- We have made a bank ledger named as SBI Bank). |

Step-2 :

![]() After creating ledgers, go to setup TDS types and enter the TDS details like its account name, percent, section and its threshold limit. Below given window will open up and user have to fill all the details.

After creating ledgers, go to setup TDS types and enter the TDS details like its account name, percent, section and its threshold limit. Below given window will open up and user have to fill all the details.

Fig 2. Setup TDS Types

Allocate Accounts To TDS Types

Step-3:

![]() In the Batch Entry tab user can allocate the TDS types to the different TDS accounts or ledgers made by the user.

In the Batch Entry tab user can allocate the TDS types to the different TDS accounts or ledgers made by the user.

![]() TDS Types- Select the TDS Type from the list as made by the user in above given figure.

TDS Types- Select the TDS Type from the list as made by the user in above given figure.

![]() Select Accounts- After selecting this option user can allocate the account to the selected TDS type.

Select Accounts- After selecting this option user can allocate the account to the selected TDS type.

![]() Select Dependent Accounts- After allocating accounts this option allows user to select the dependent account from the list.

Select Dependent Accounts- After allocating accounts this option allows user to select the dependent account from the list.

Fig 3. Batch Entry

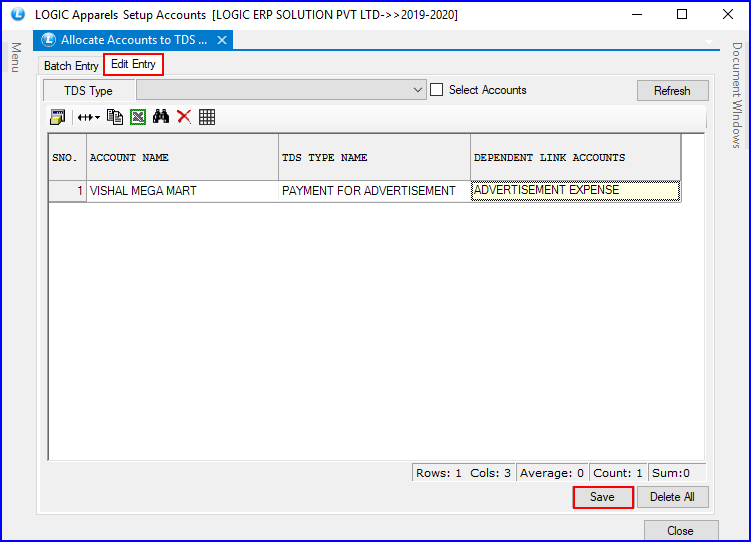

![]() After allocating accounts in Batch Entry go to the another tab Edit Entry where user can edit or can make changes in the allocated accounts.

After allocating accounts in Batch Entry go to the another tab Edit Entry where user can edit or can make changes in the allocated accounts.

![]() By clicking on Refresh button usercan see all the entries made by the user in batch entry tab.

By clicking on Refresh button usercan see all the entries made by the user in batch entry tab.

Fig 4. Edit Entry

Recording Basic TDS Transactions

In this section we shall emphasis on understanding how Logic ERP TDS feature can be effectively used to record basic TDS transactions to generate TDS Challan.

Let us take the example of ABC PVT LTD. (Ledger/Party Created) to record TDS transactions such as:

![]() TDS on Expenses

TDS on Expenses

![]() Payment to Party

Payment to Party

![]() Payment of TDS

Payment of TDS

In Logic ERP, you can account for expenses implying TDS with the help of Payment Voucher, Journal Voucher or Purchase Voucher, as required.

Transactions Involving TDS:

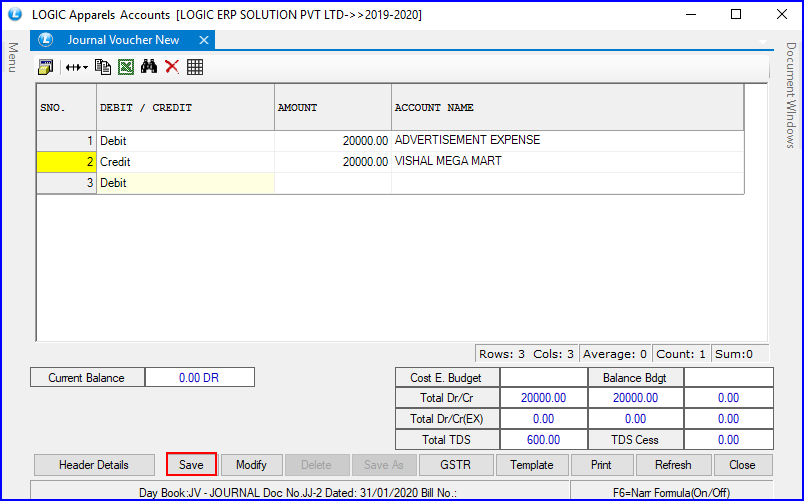

![]() TDS on Advertisement (Journal Voucher) - Under this, we will learn to Account expenses and deduct tax at source to arrive at the Net balance payable to the party.

TDS on Advertisement (Journal Voucher) - Under this, we will learn to Account expenses and deduct tax at source to arrive at the Net balance payable to the party.

Example-

On 31st Jan,2020 Logic ERP Solution Pvt Ltd received a bill no- 0 from Vishal Mega Mart for Rs.20000 towards the advertisement services rendered.

![]() Record the Transaction in Journal Voucher.

Record the Transaction in Journal Voucher.

![]() Select A2_Customer in the Debit field and press Enter.

Select A2_Customer in the Debit field and press Enter.

![]() Enter the amount 20000 in the Amount field.

Enter the amount 20000 in the Amount field.

![]() Select party that is ABC PVT LTD. in the Credit field and press Enter.

Select party that is ABC PVT LTD. in the Credit field and press Enter.

Fig 5. Journal Voucher Entry

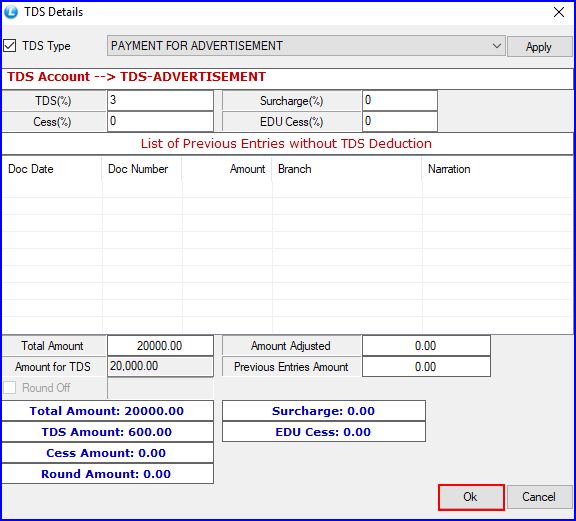

![]() After entering credit details in journal voucher a TDS window will appear in which user can select the TDS type and if user wants to deduct TDS then click on Apply button.

After entering credit details in journal voucher a TDS window will appear in which user can select the TDS type and if user wants to deduct TDS then click on Apply button.

Fig 6. TDS Details

Example-

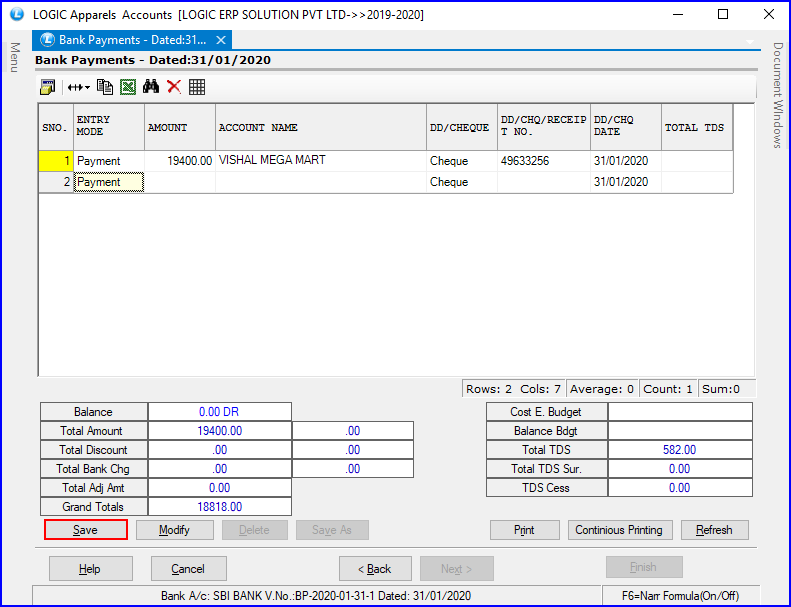

On 31st Jan,2020 payment of Rs.19,400 is made towards document no BP-2020-01-31-1 to Vishal Mega Mart for the purchase of Advertisement services, with cheque no. 49633256.

![]() Go to Bank Payments form from the main menu.

Go to Bank Payments form from the main menu.

![]() Fill the header details of the voucher.

Fill the header details of the voucher.

![]() Select the entry mode then in account name select Vishal Mega Mart from the list of ledger accounts.

Select the entry mode then in account name select Vishal Mega Mart from the list of ledger accounts.

![]() Enter Rs.19,400 in Amount field and then click on save button.

Enter Rs.19,400 in Amount field and then click on save button.

.

Fig 7. Bank Payment To Party

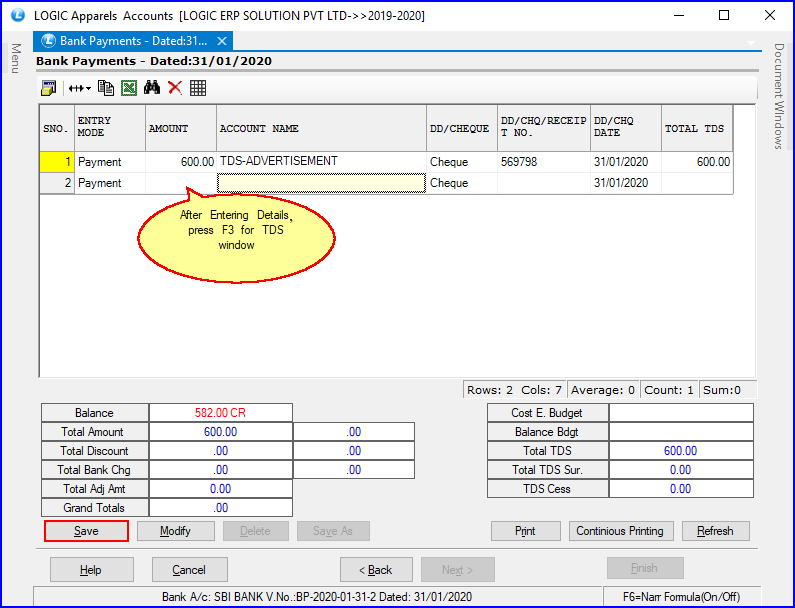

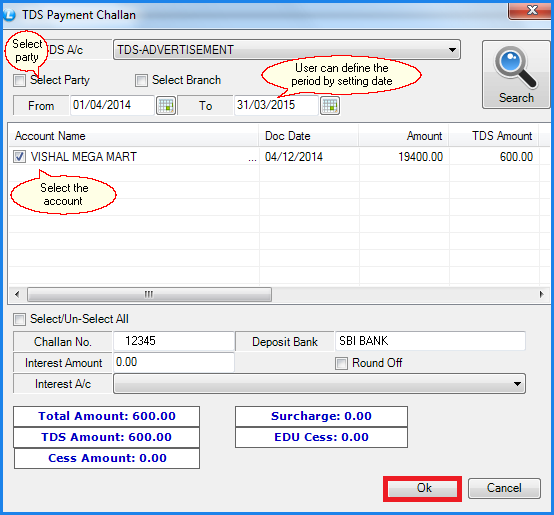

All the Tax deducted during a month is to be paid to the credit of Government on or before 7th of the next month. In case 7th of the month happens to be a Sunday or a bank holiday payment can be made on the next working day.

Example-

On 31 Jan,2020, Vishal Mega Mart paid TDS of Rs.600 towards Advertisement Expenses with cheque no. 569798 for the month of Jan,2020.

Fig 8. Bank Payment Of TDS

![]() After entering credit details in journal voucher a TDS window will appear in which user can select the TDS type and if user wants to deduct TDS then click on Apply button.

After entering credit details in journal voucher a TDS window will appear in which user can select the TDS type and if user wants to deduct TDS then click on Apply button.

Fig 9. TDS Details