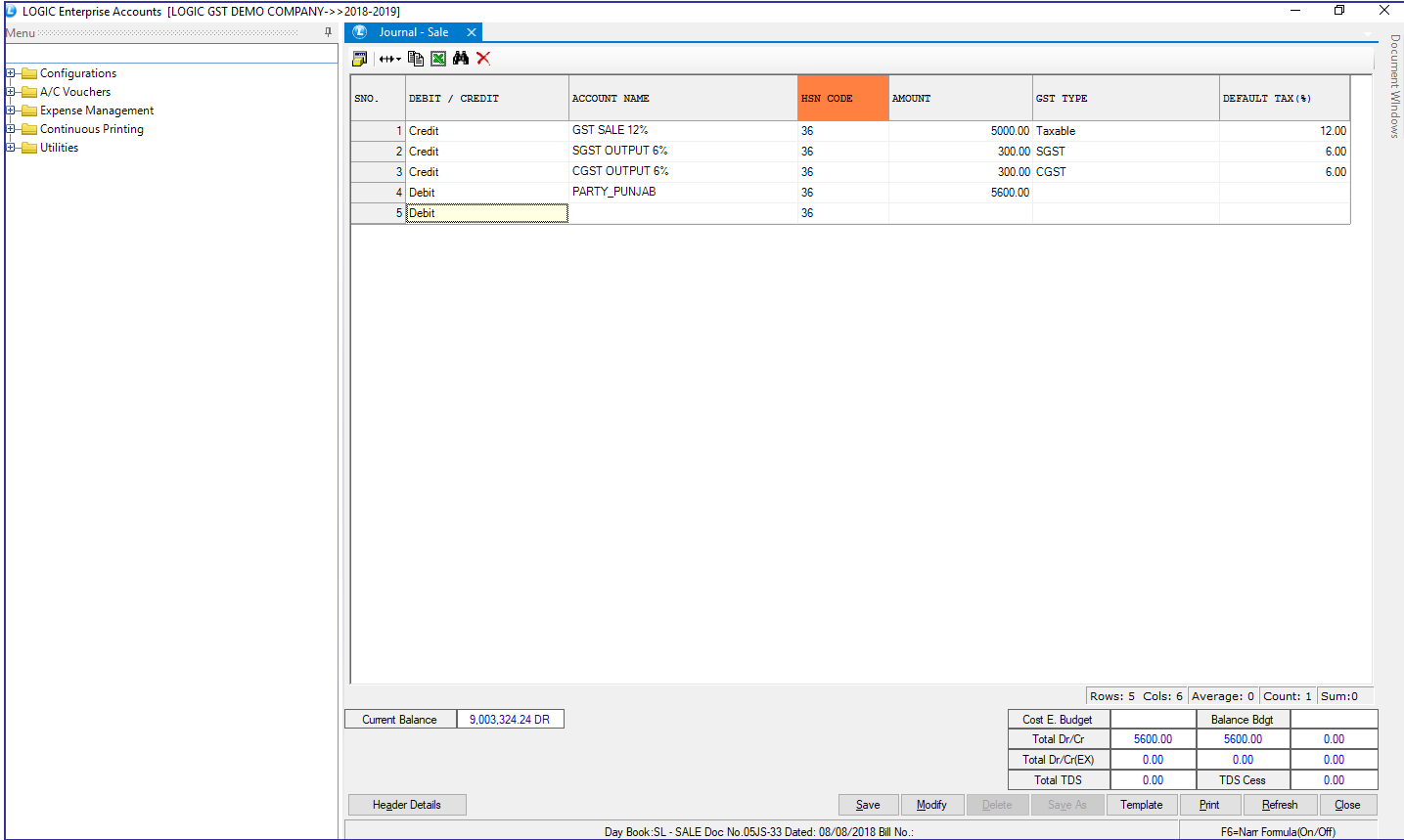

Feature added in Journal Voucher to Pick Tax A/c Auto from Tax Master: Journal Vouchers (Sale/ Sale Return and Purchase/ Purchase Return) can be used to automatically apply GST Tax in transactions. When you select Sale account, it will automatically pick and calculate percentage of CGST and SGST tax account.

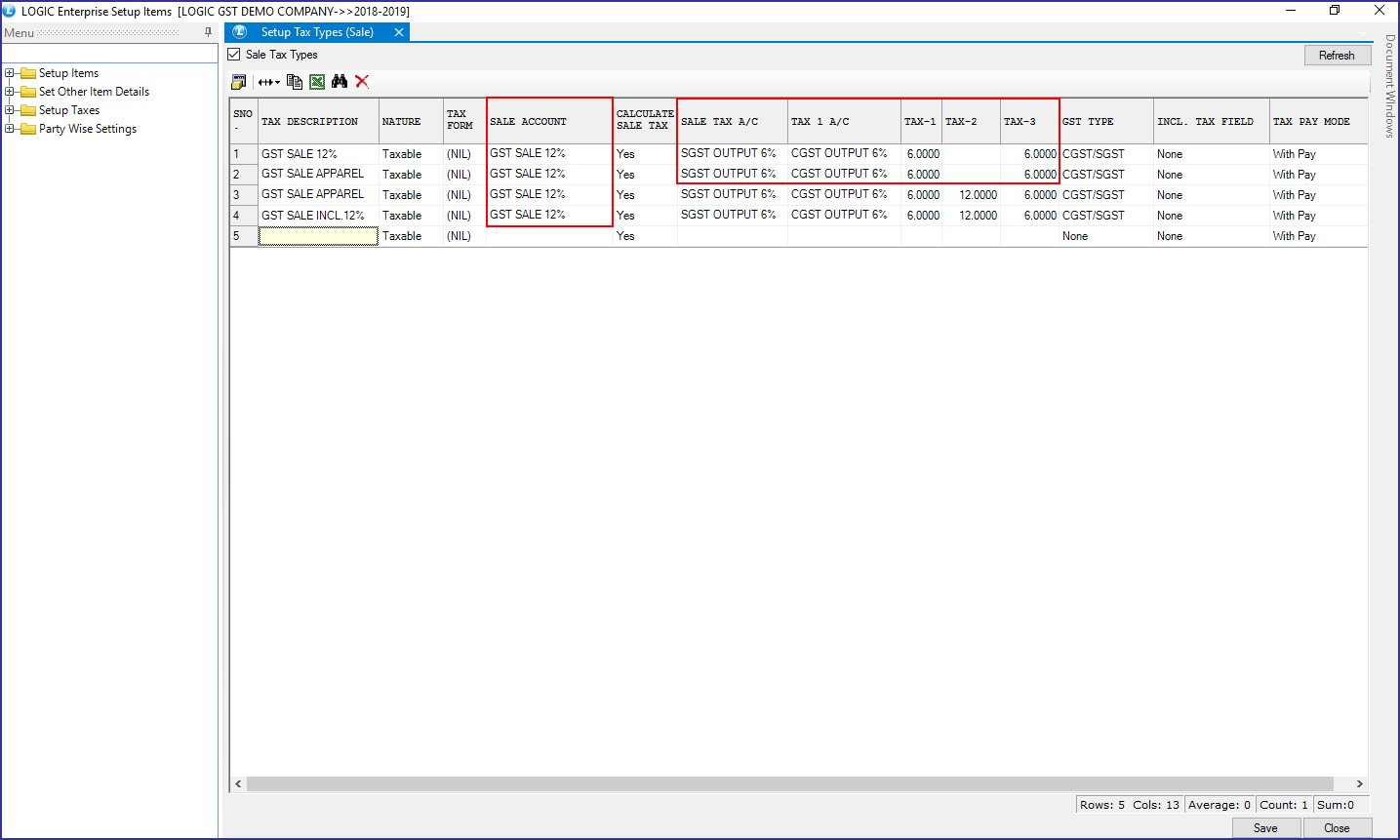

For example you have selected Sale Account GST SALE 12% and its Sale Tax Accounts are SGST OUTPUT 12% and CGST OUTPUT 12%. Above mentioned feature is to calculate Sale Tax Account automatically for Sale Account

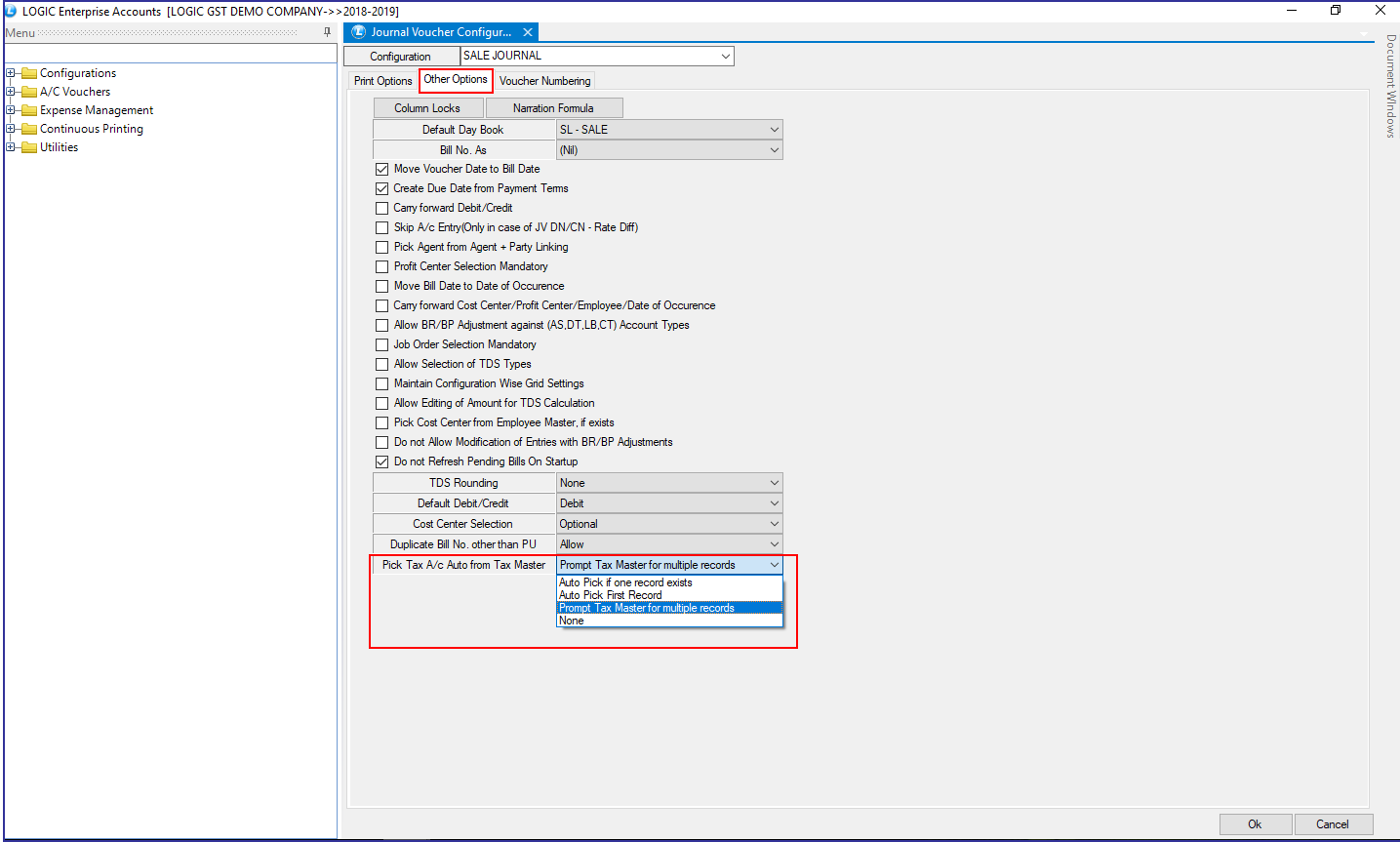

Main Menu: Accounts> Configuration> Journal Voucher Configuration

Open Journal Voucher Configuration. Click on Other Options and then Pick Tax A/c Auto from Tax Master. It will allow you to auto pick the taxes in four different types i.e. Auto Pick if one record exists, Auto Pick First Record, Prompt Tax Master for multiple Records and None.

1. Auto Pick if one record exists: This option is applicable if only one SALE ACCOUNT record is available. It will automatically calculate GST taxes as per selected Sale account.

2.Auto Pick First Record: If you have multiple sale accounts but want automatically to pick first record out of them, select this option. For example: you have four accounts under GST Sale 12%. Now, if you want to select first record of GST Sales 12%, you need to select this option.

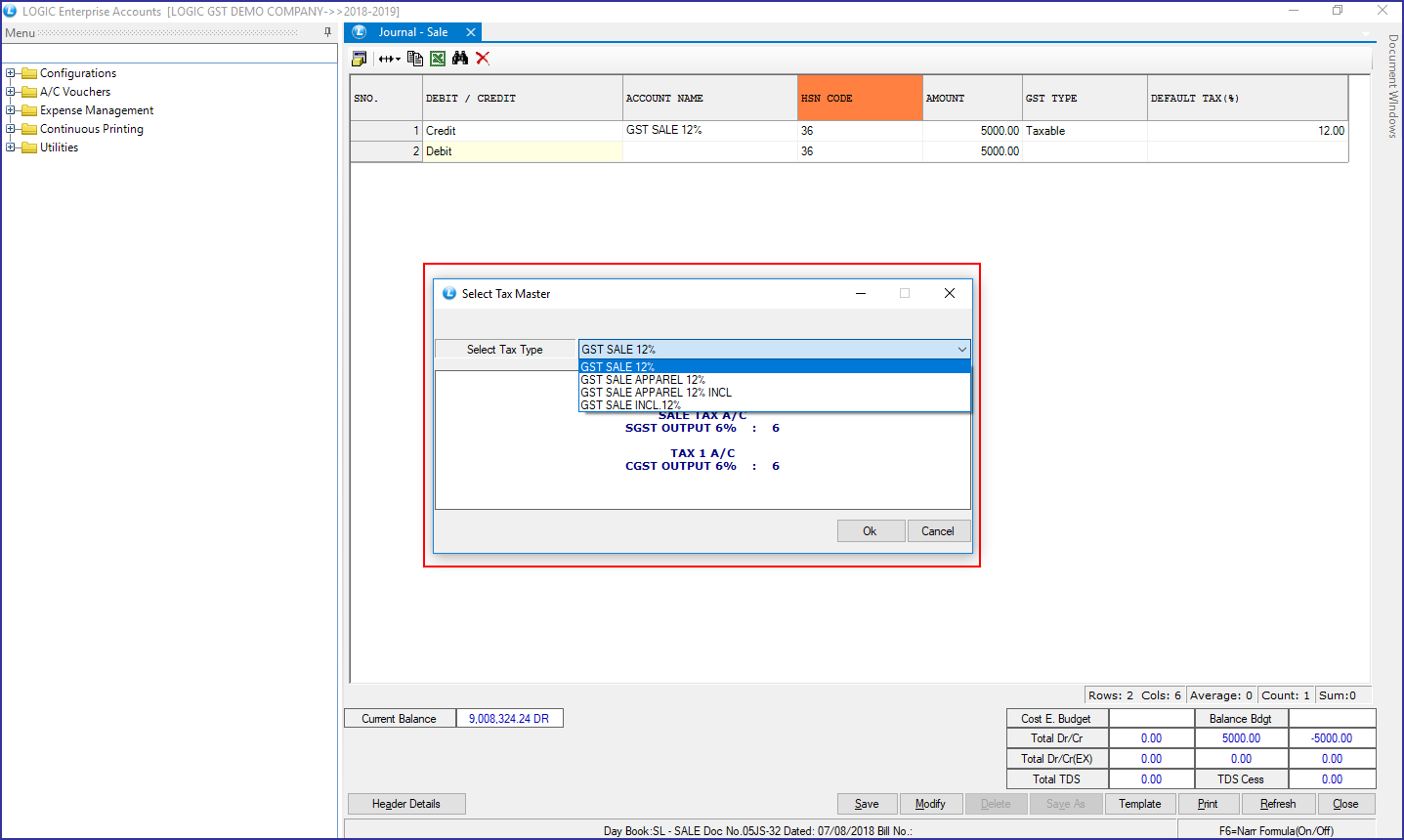

3.Prompt Tax Master for multiple Records: If you want have multiple GST tax account and want to prompt it, click on this option. For example: you have GST Sale 12% SALE ACCOUNT, linked to five different TAX ACCOUNTS and you want to prompt and select any one out of these, click on this option.

4.None: If you don’t want to apply any such condition on GST Sale tax accounts and put CGST and SGST taxes manually like before, select option NONE.