Features added in GST Returns Report: We have introduced following new options in GST Returns Report:

1) GST Summary Report

2) Prepare JSON File button in GSTR-3B:

3) Reconciliation button added in GSTR- 2

Main Menu: Reports/ Queries> Sale Registers> GST Reports/ Returns> GST Returns

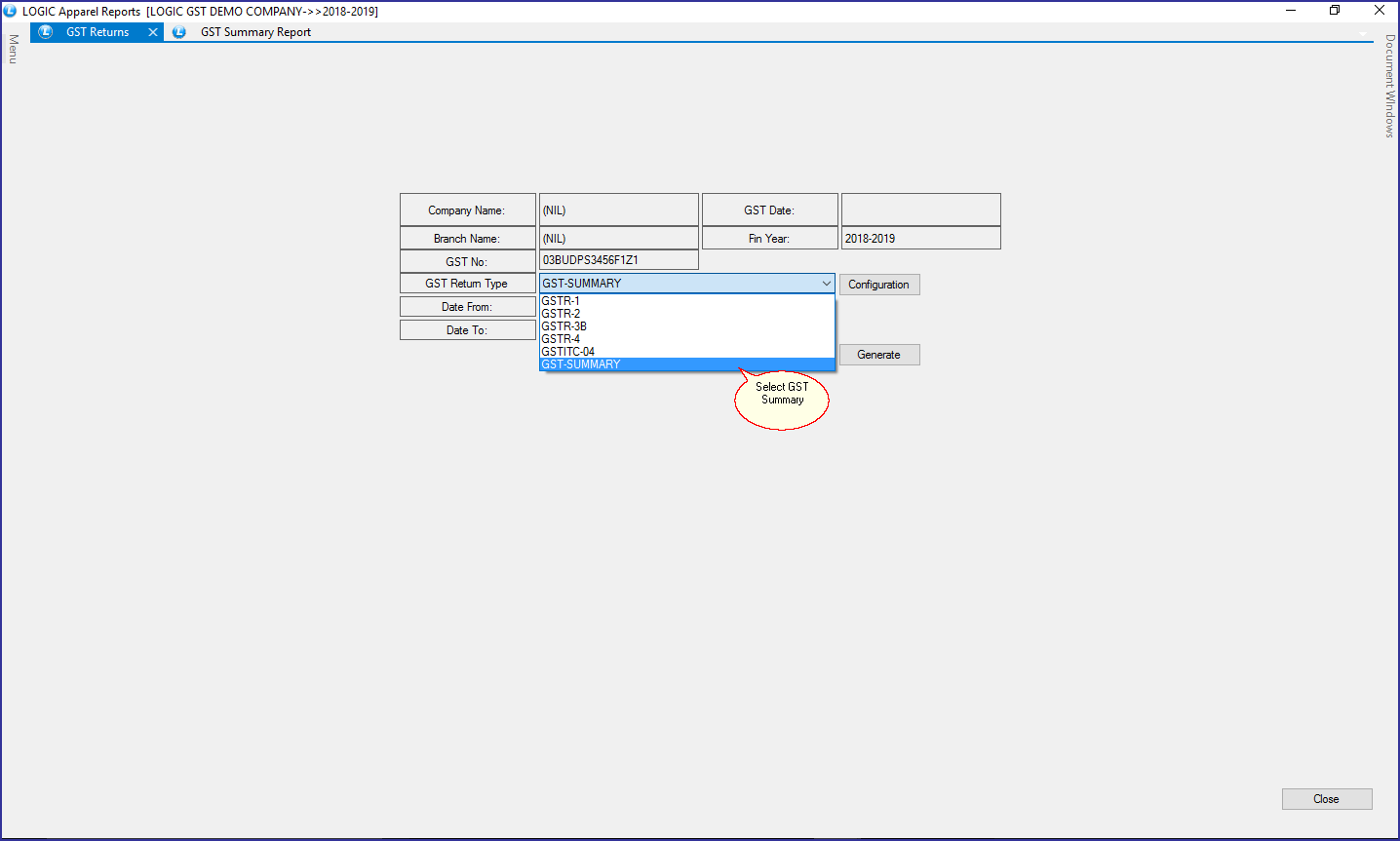

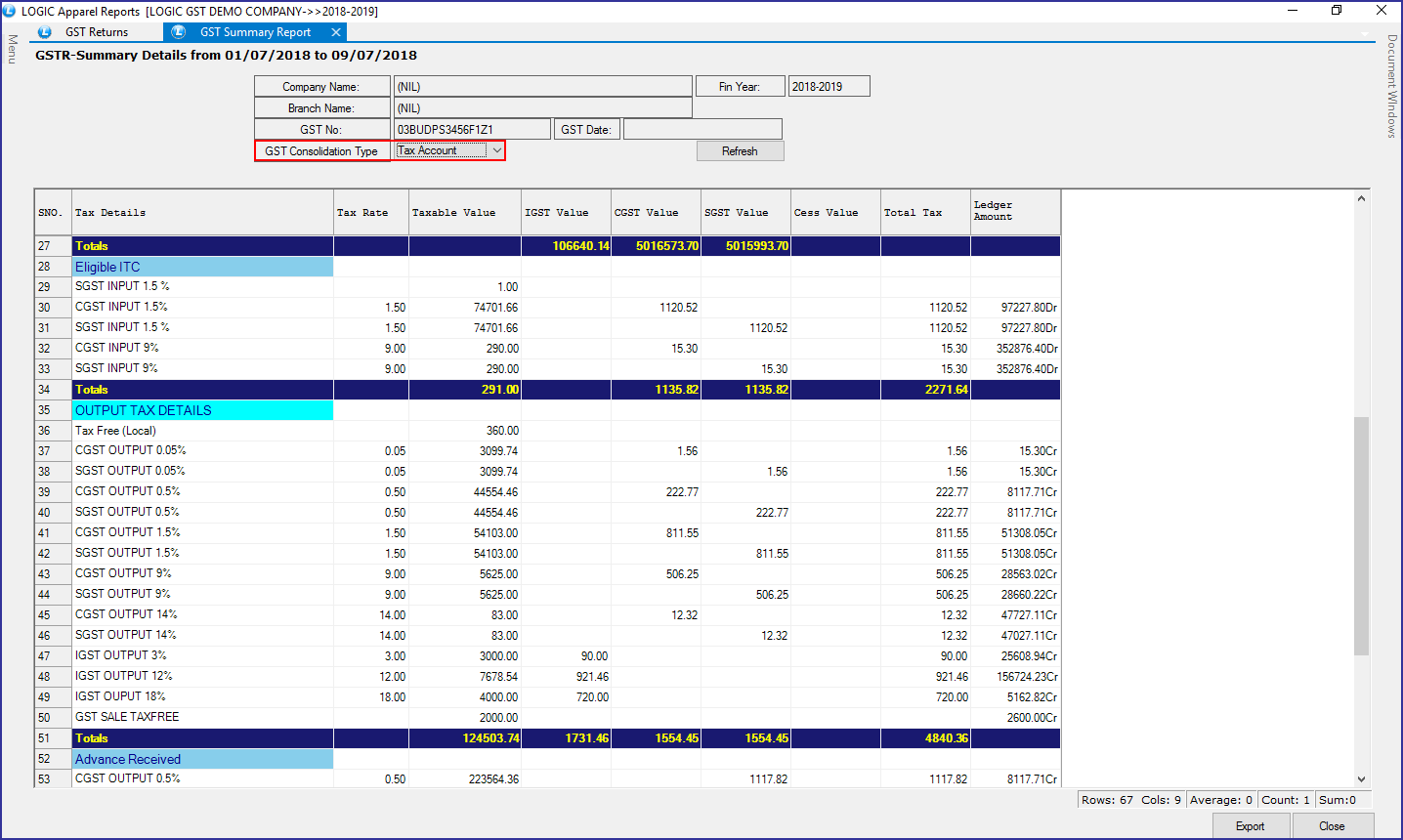

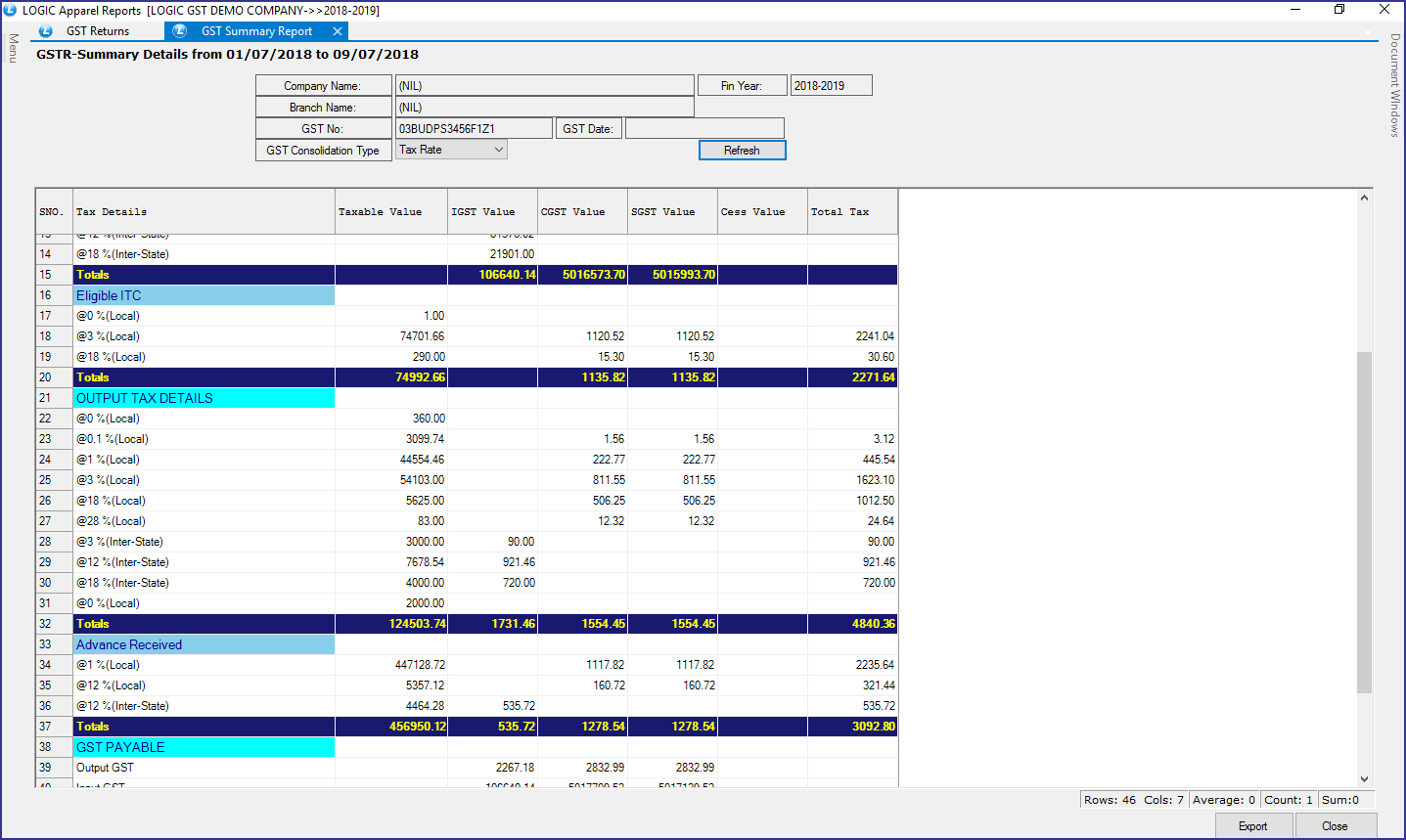

GST Summary Report Added in GST Returns Report to analyse the summarised details of GST Returns. You can evaluate Total Output, Total Input, Advanced Received and Total GST Payable in one report. You can Consolidate GST Report as Tax Account or Tax Rate.

GST Returns window will appear on your screen. Select GST Return Type As GST Summary and select Duration that you want to see for GST Returns. Click on Generate button.

Tax Account: If you want to summarise the GST Returns on the Tax Account basis, Select GST Consolidate Type as Tax Account and Press Refresh.

Tax Rate: If you want to summarise the GST Returns on the Percentage basis, Select GST Consolidate Type as Tax Rate and Press Refresh.

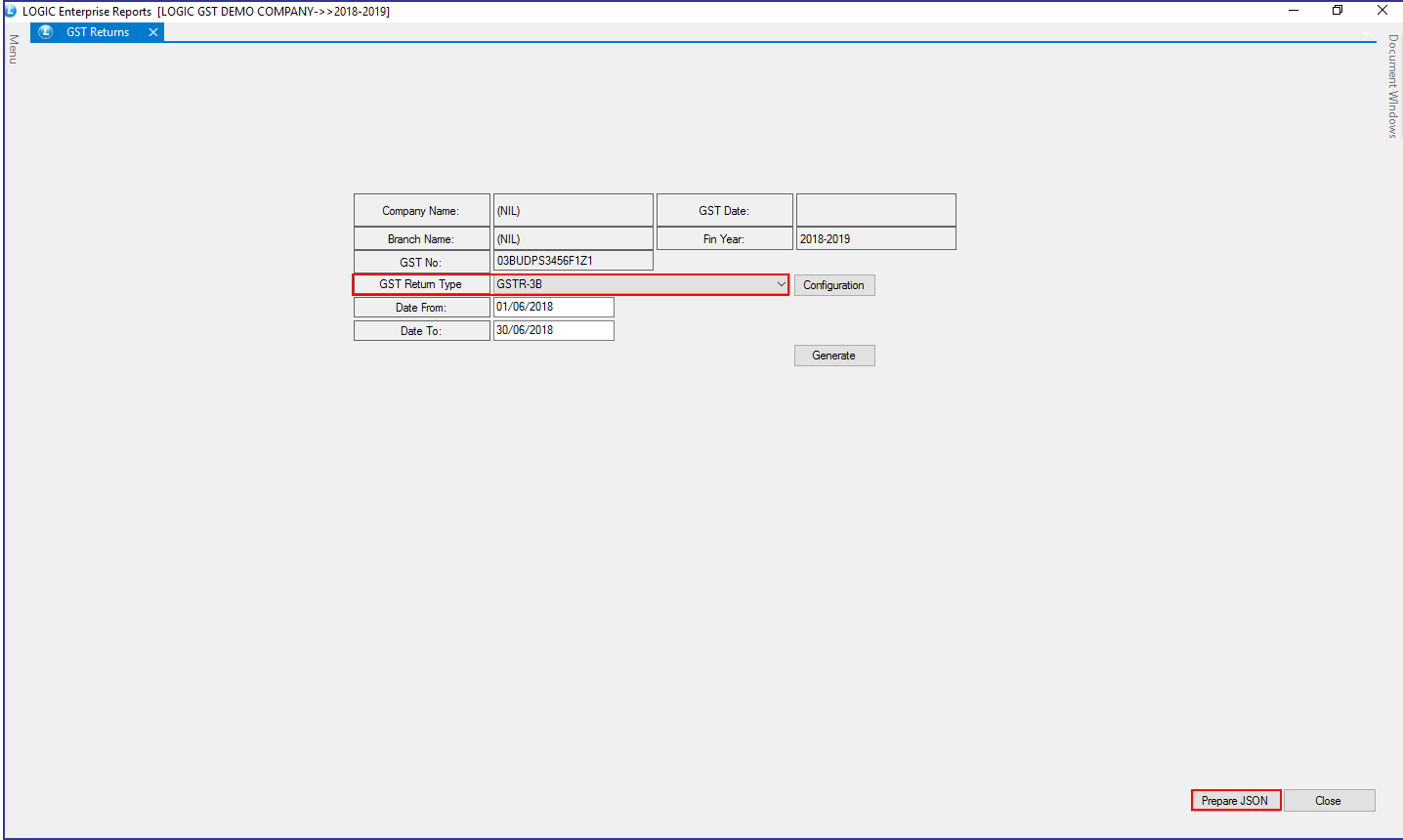

Prepare JSON File button in GSTR-3B: JSON file is a type of computer file based on Java that is easy for humans to read and write. JSON file is used by the GSTN for GST return preparation and filing. GST returns can be filed on the GST Portal using a JSON file. The Government has provided an offline GST return preparation tool that generates JSON file that can be filed on the GST Portal.

LOGIC Software provides JSON format GST returns that can be uploaded to GST portal for easily filing GSTR-3B. Select GST Return Type As GSTR-3B. Prepare JSON button will appear on your screen. Click on it to prepare JSON file.

The file will appear in the drive where your software is installed under such path: D:\LOGIC\GPC\GST Returns.

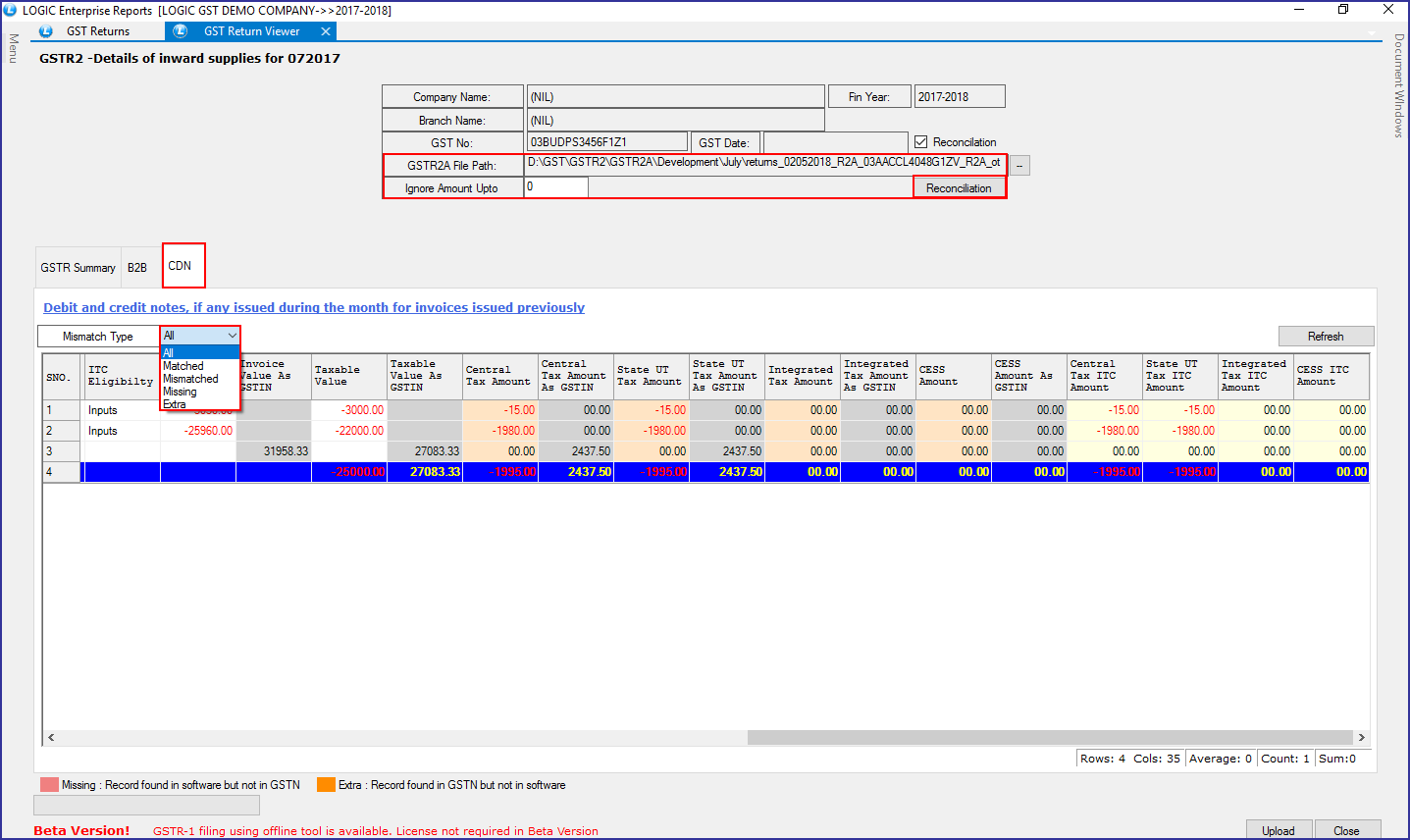

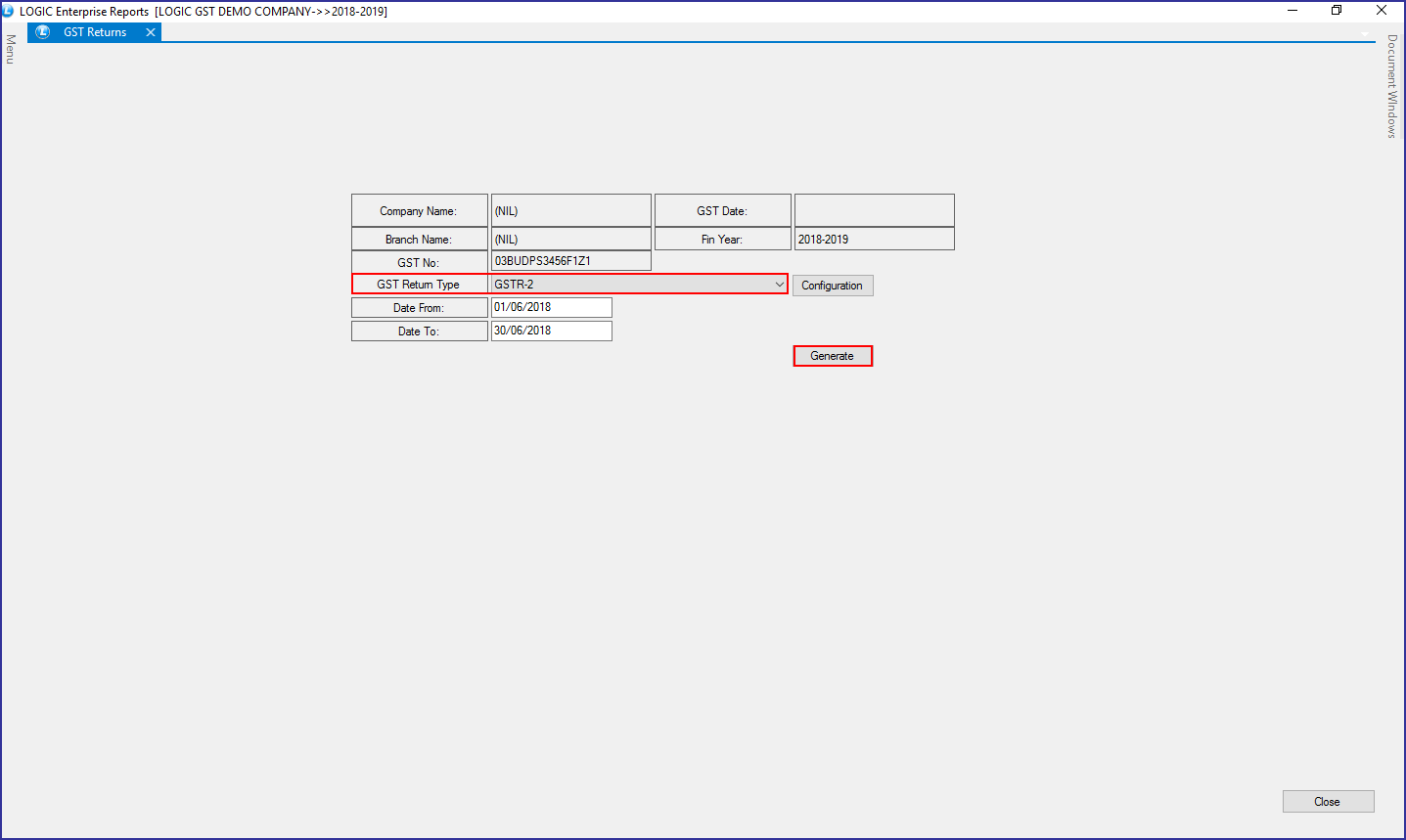

Reconciliation button added in GSTR- 2: To file GSTR2 reconciliation of invoices must be carried out to compare the invoices submitted by both supplier and purchaser. GSTR 2 contains the details of inward supply, while GSTR 2A is related to supplies recorded by the supplier , that is auto-populated on the GST portal, when the supplier files his GSTR1. Reconciliation under GST ensures Input Tax Credit (ITC) can be availed. If mismatches are found, the process of correcting it can be time consuming, as vendors will need to be contacted to create new invoices with the changes needed. LOGIC Software has introduced the reconciliation button in GSTR-2.

GST Returns window will appear on your screen. Select GST Return Type As GSTR-2. Click on Generate button.

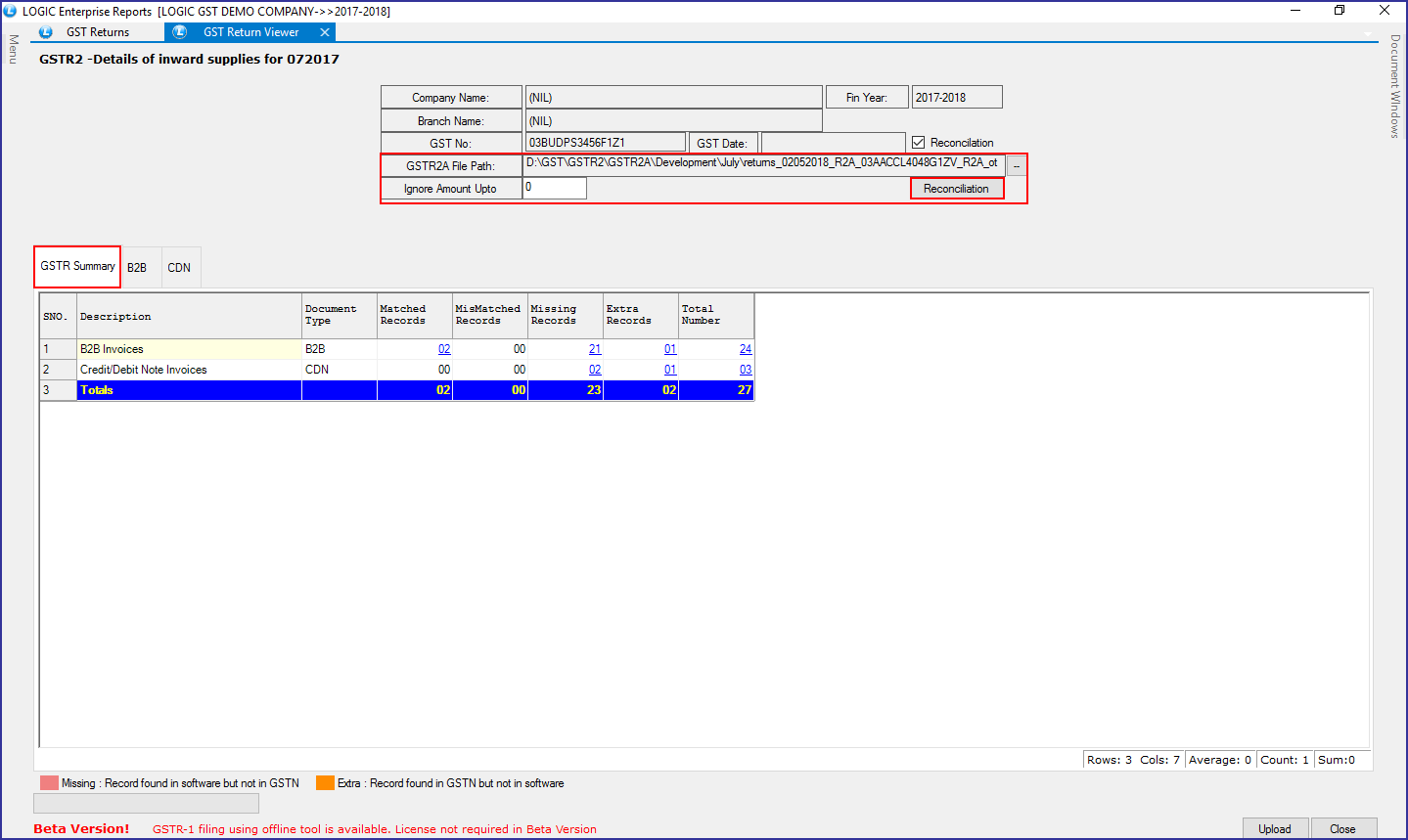

Enter path of GSTR2A File that you have downloaded from Government’s Portal. Select Reconciliation option.

GSTR Summary:

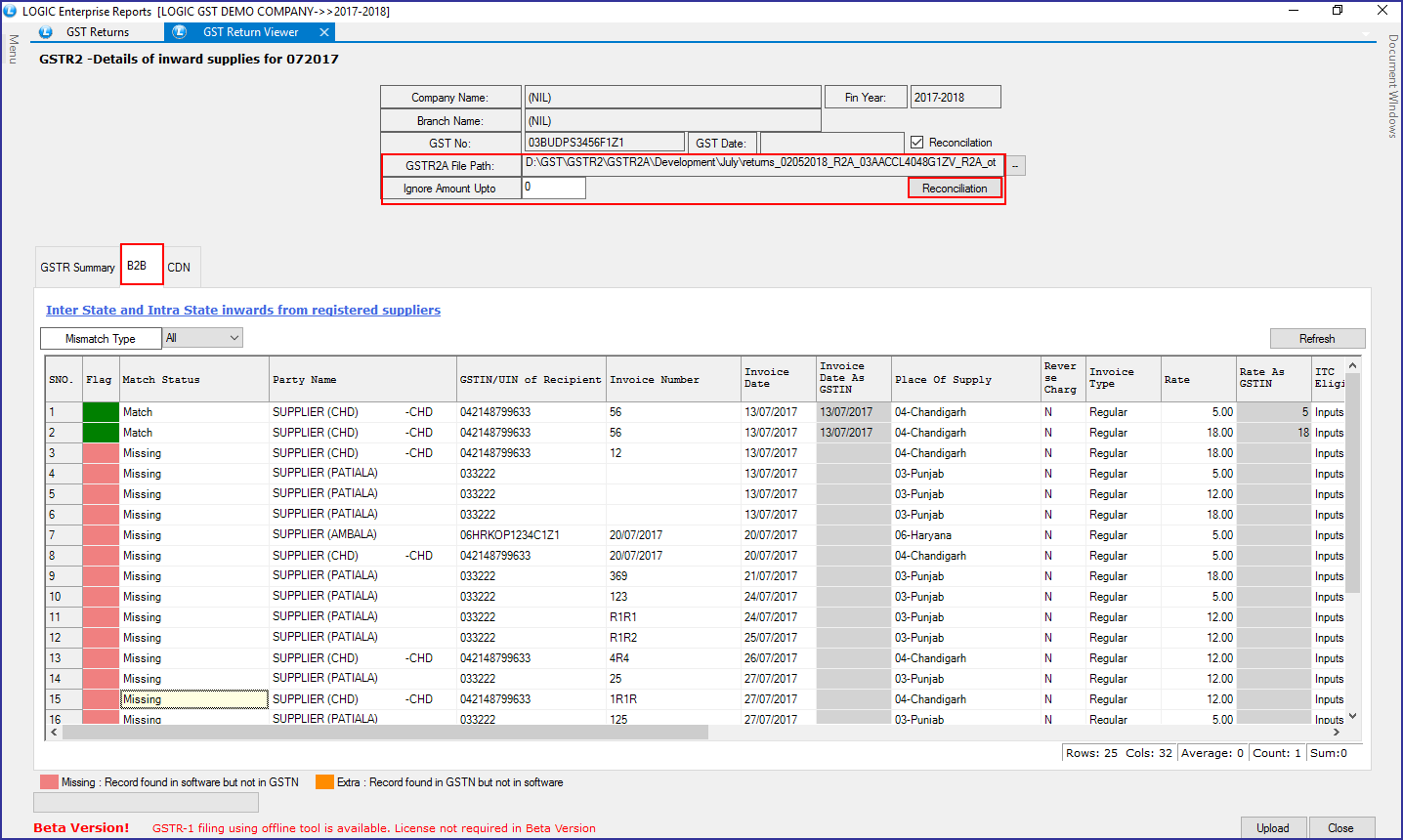

B2B:

CDN: