Option introduced to Enter Accounting Voucher of GSTR in Journal Vouchers: GST has become a very important part of business accounting. We have introduced a new feature in our software using which you can retrieve GSTR summary directly in journal voucher for posting in accounts and transfer GSTR liabilities to payable accounts.

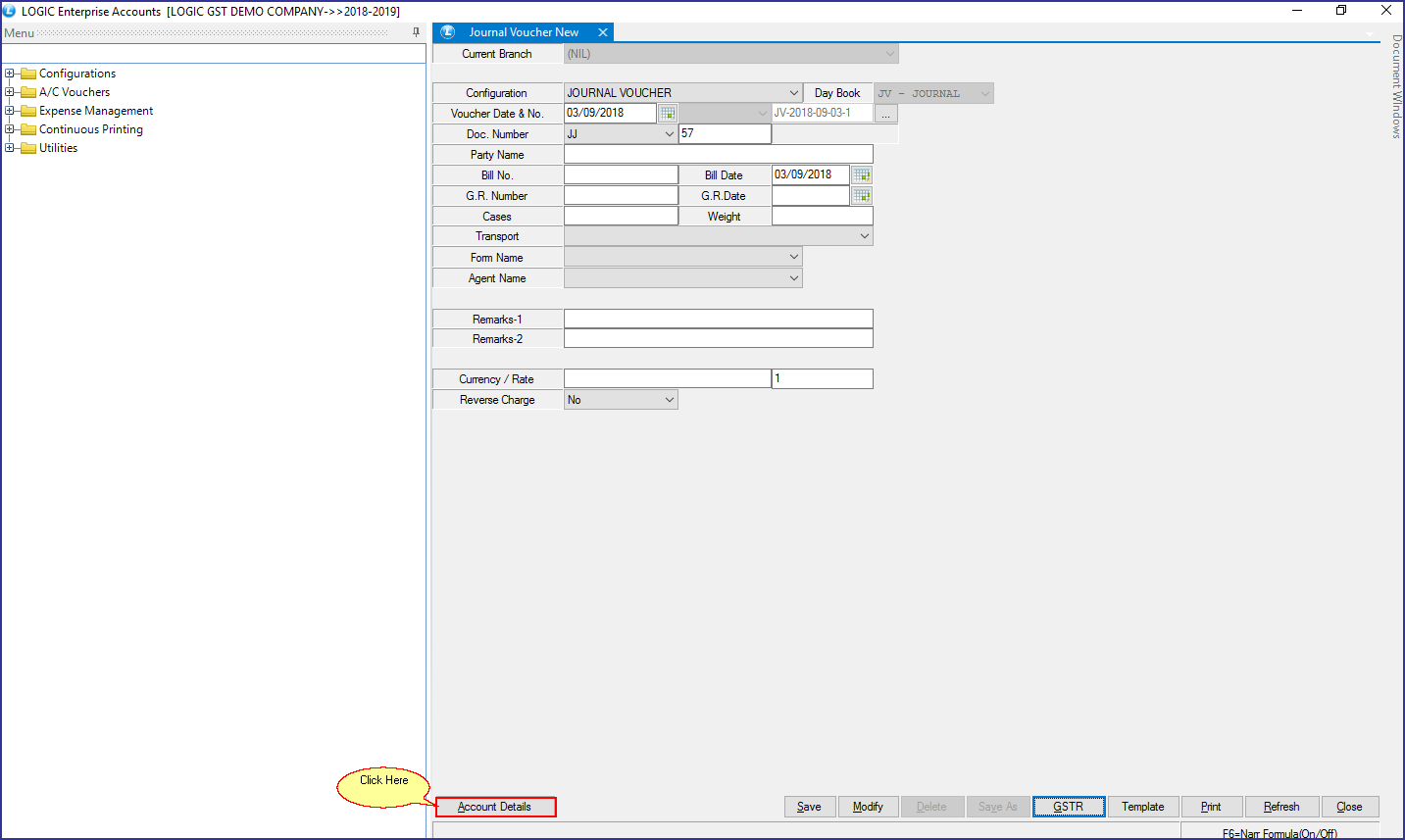

Main Menu: Accounts> Accounting Vouchers> Journal Vouchers

Journal Voucher New window will appear on your screen. Enter Details and click on Account Details button.

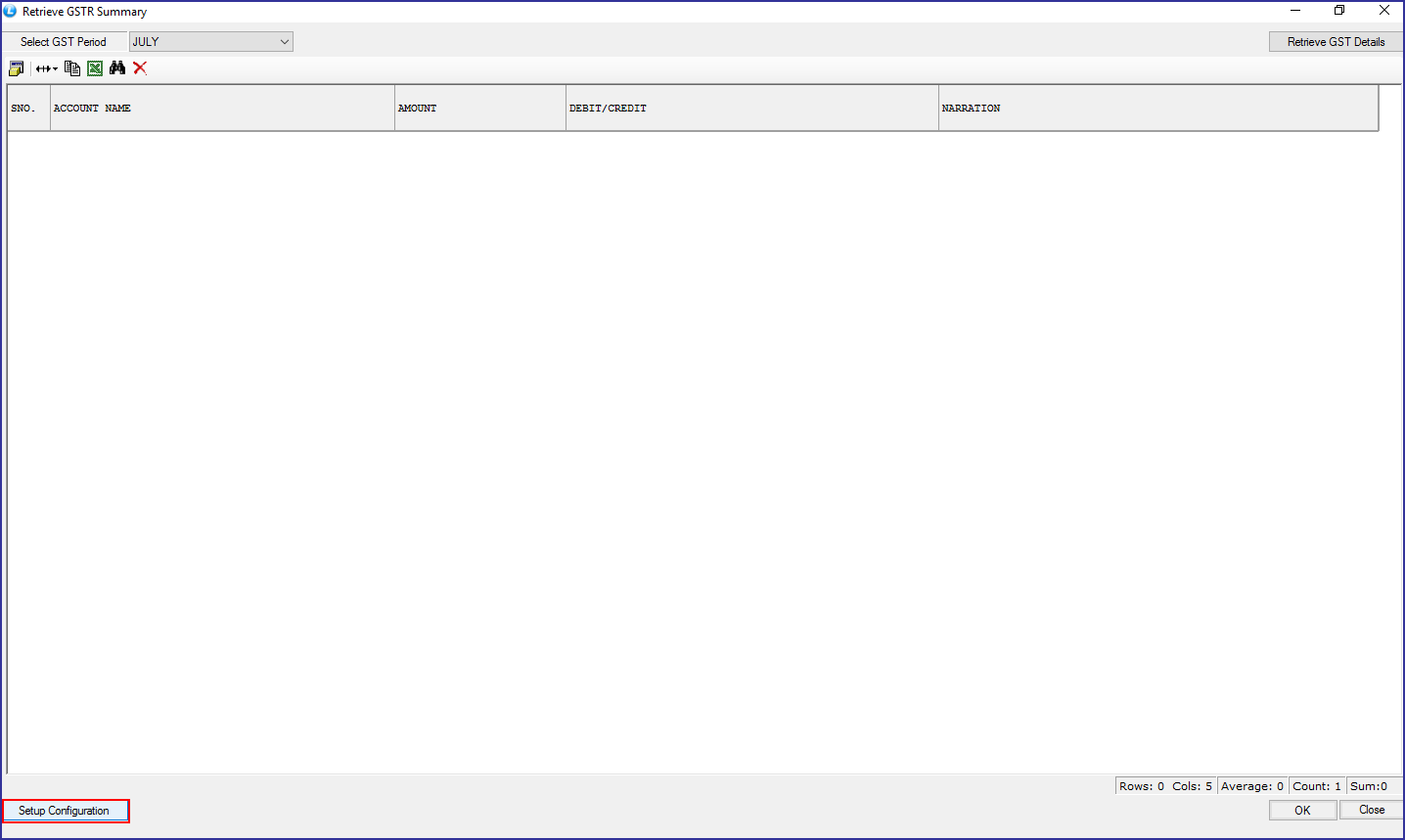

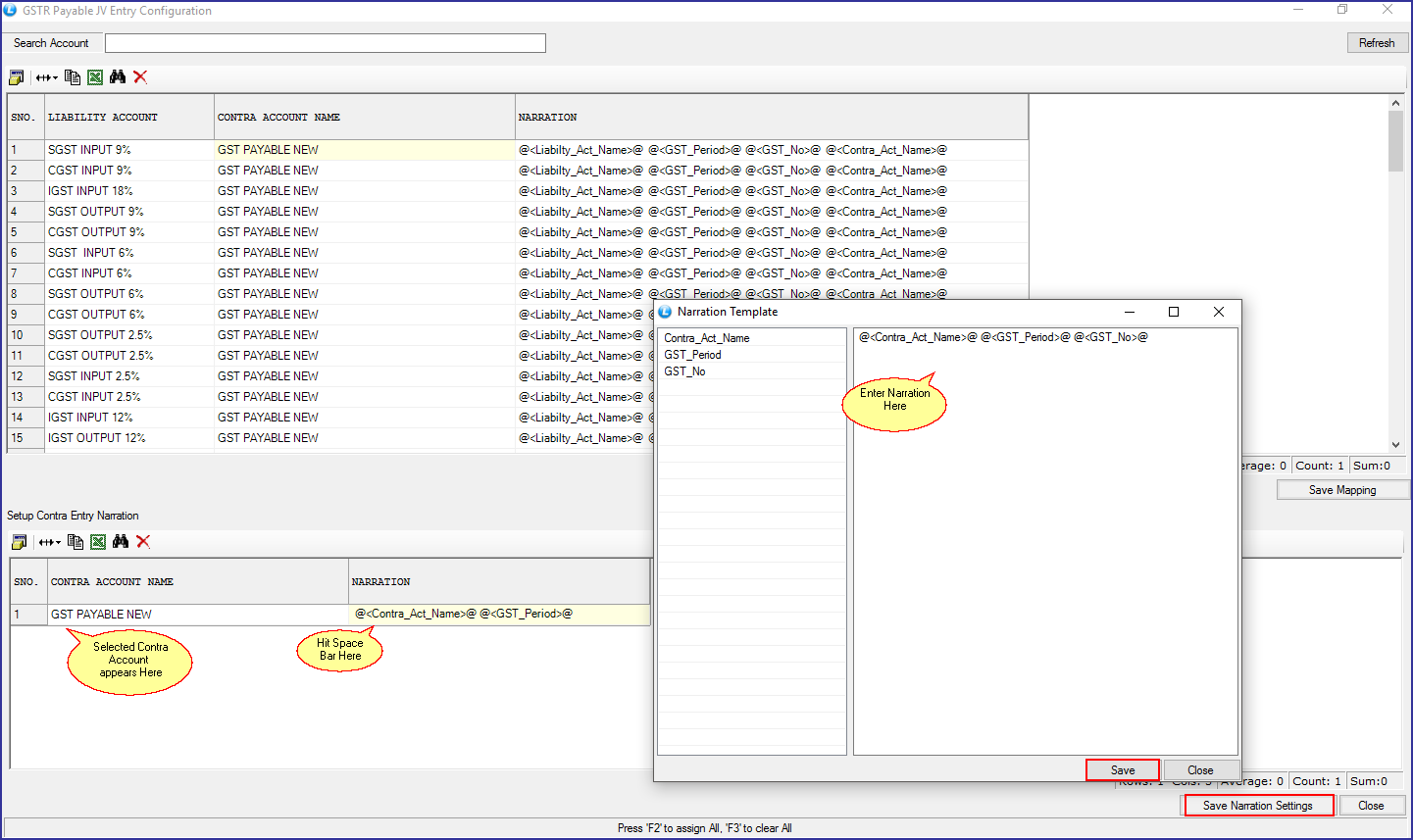

Retrieve GSTR Summary window will appear on your screen. Click on Setup Configuration.

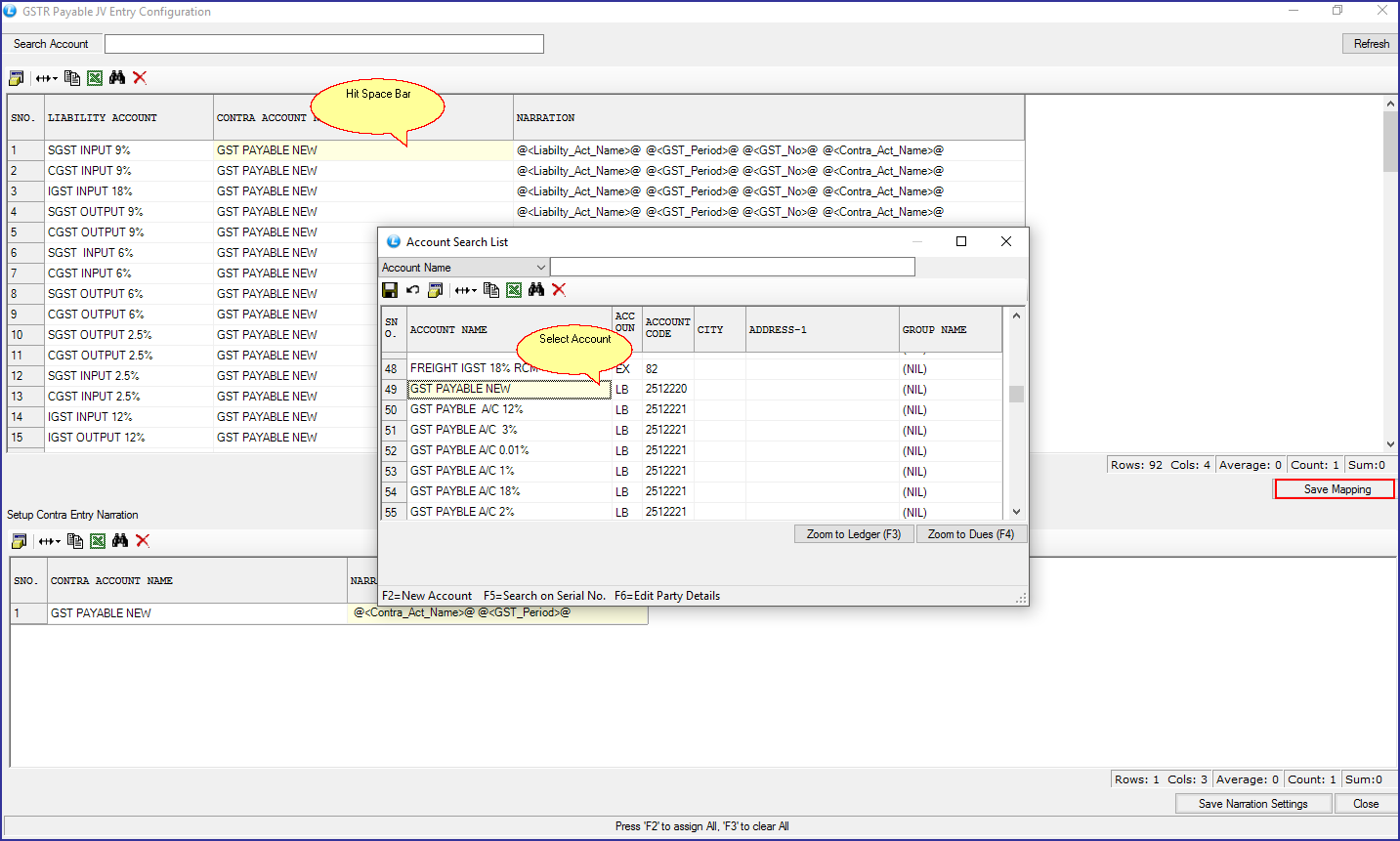

Hit space bar on Contra Account. Account Search List will appear on your screen. Select account you want to map with Liability Account and Click on Save mapping button. Suppose you selected GST Payable New account.

Selected mapped account will appear on the below. Hit space bar on Narration. Narration Template window will appear on your screen. Set the narration for the mapped account and click on Save button. Then, click on Save Narration Settings and close the window.

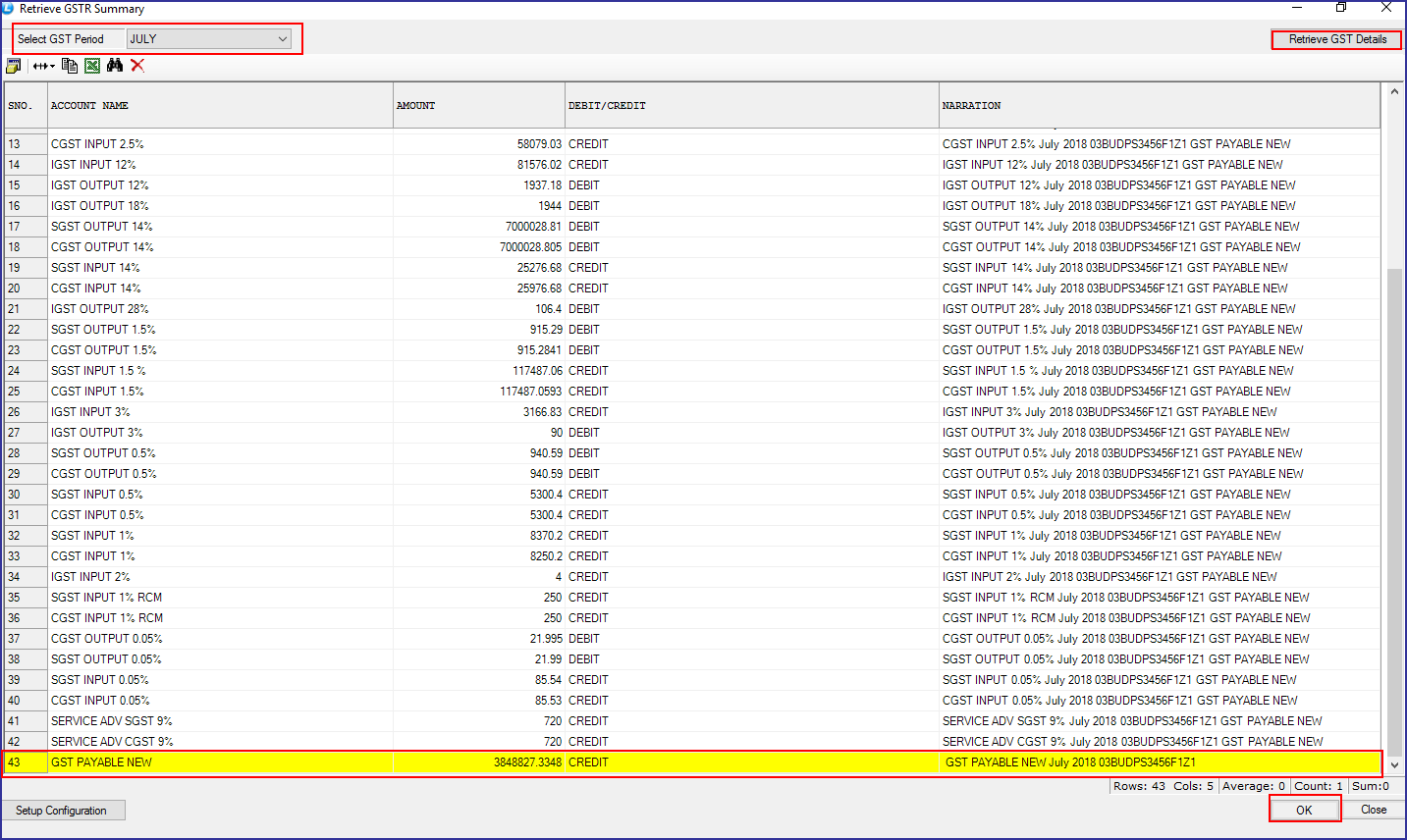

Suppose you selected GST Period for the month of July. Now, click on the Retrieve GST Details button. You can see the GST Payable New amount with other accounts. Its amount will be same as in GSTR Summary for the specified duration. Now, click on Ok button to generate Journal Voucher.

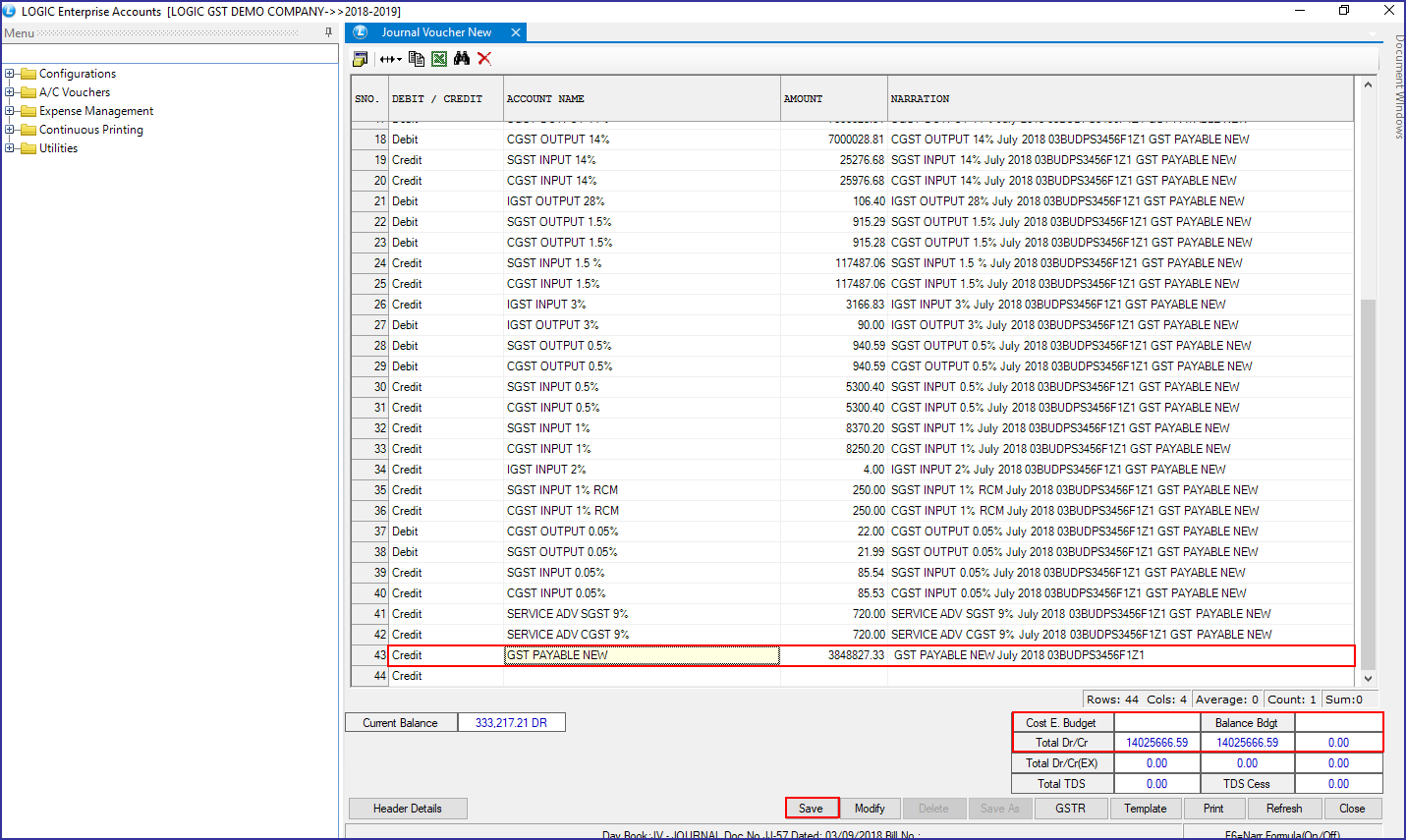

As shown below, all the entries are automatically placed in the grid. Click on the Save button to Save this voucher.

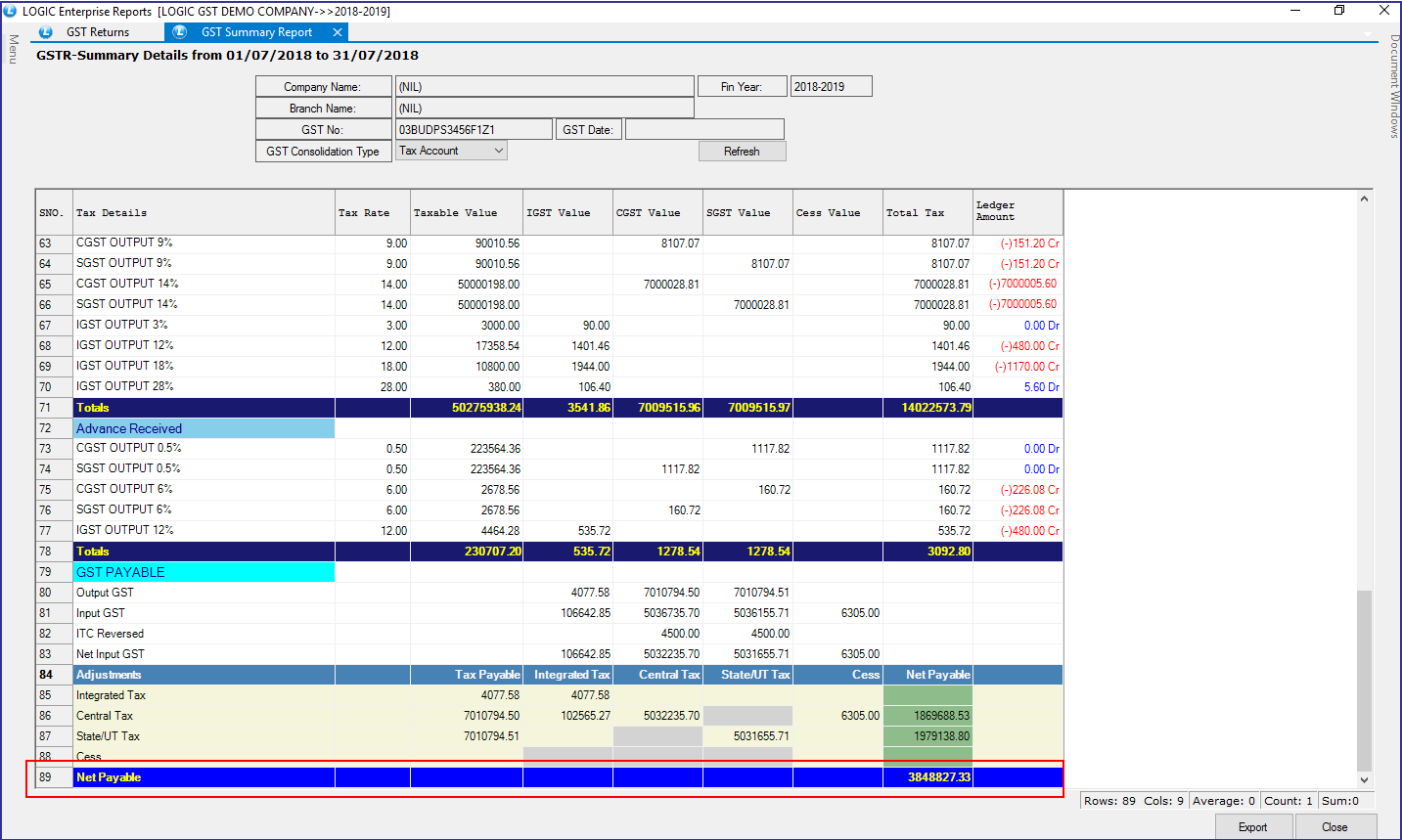

For example: The net payable value of GSTR Summary and Journal Voucher of the same Period are same. See below: