Key Billing Terms Every Business Owner Should Know

Introduction

Understanding billing terms can help the retailers, distributors and wholesalers to have deep insights into how the payment works. Whether you run a small startup or a growing enterprise, knowing the right billing terminology ensures billing accuracy, faster payments, strong cash flow management, and full tax compliance.

Many payment delays, disputes, and audit issues happen simply because business owners misunderstand invoicing and billing terms. Clear knowledge of billing terms for business owners helps create standardized invoicing, improves financial transparency, and supports audit-ready records.

Using a modern Billing Software also makes it easier to apply these terms correctly, automate calculations, and maintain regulatory compliance across the entire business invoicing process.

What Are Billing Terms and Why They Matter

Billing terms are standardized definitions used in invoices and financial documents that ensure accurate invoicing, timely payments, and regulatory compliance for businesses.

-

Definition of billing terms

Billing terms are standardized words and definitions used in invoices, bills, and financial documentation. They explain how billing works, when payments are due, how taxes apply, and how adjustments are handled. For beginners, billing terms explained in simple language help avoid costly mistakes.

-

Impact on invoicing, cash flow, and compliance

Clear billing terminology explained with examples ensures:

1. Accurate Invoice Management

When businesses apply the correct invoicing and billing terms, it ensures every invoice is detailed, standardized, and error-free. Proper use of terms like line items, due date, and payment terms avoids confusion for clients, reduces mistakes, and supports financial documentation. Accurate invoice management improves transactional accuracy and helps in reconciliation at month-end or during audits.

2. Smooth Payment Processing

Correct use of billing terminology like advance payment, part payment, and outstanding amount ensures that payment processing happens efficiently. Clients clearly understand their obligations, which reduces delays. Automated billing software can track payments in real-time, improving operational efficiency and ensuring secure billing practices.

3. Better Accounts Receivable Control

With a clear understanding of billing terms used in invoices, businesses can monitor accounts receivable more effectively. Knowing the meaning of due date, credit note, and debit note allows companies to follow up on late payments, manage cash flow, and maintain audit-ready records. This strengthens financial transparency and reduces the risk of bad debts.

4. Reduced Disputes and Faster Reconciliation

Standardized billing terms in GST invoicing and accurate line items help minimize disputes between businesses and clients. Proper documentation ensures fiscal compliance, making reconciliation quicker and more precise. Dispute-free invoices save time, reduce manual errors, and improve financial reporting.

5. Compliance with Statutory Requirements and Tax Laws

Applying correct billing terminology such as tax invoice, GST, CGST, SGST, IGST, HSN/SAC codes, and ITC ensures full compliance with tax laws and regulatory standards. Businesses maintain compliance-ready records that are audit-friendly, reducing the risk of penalties and legal issues.

-

Relevance for small and growing businesses

Understanding billing terms for business owners is especially important for small and growing businesses. Proper knowledge improves financial transparency, operational efficiency, and cash flow management.

For small businesses, understanding accounting and billing terms for small businesses improves operational efficiency, supports transactional accuracy, and prepares the company for scaling using an automated billing system or ERP System. Here’s why it matters:

- Accurate Invoicing – Knowing billing terms like invoice, proforma invoice, tax invoice, and credit/debit notes ensures every invoice is precise, reducing errors and disputes.

- Better Cash Flow Management – Clear payment terms and due dates help small businesses predict cash inflows, plan expenses, and maintain financial stability.

- Regulatory Compliance – Correct usage of GST, CGST, SGST, IGST, HSN/SAC codes, and ITC ensures compliance with tax laws, avoiding penalties or fines.

- Operational Efficiency – Standardizing billing terminology simplifies accounts receivable tracking, reconciliation, and reporting, freeing time for strategic business growth.

- Professionalism and Trust – Consistent, accurate invoices with clear terms enhance credibility with clients, promoting timely payments and long-term business relationships.

- Scalability – A solid understanding of billing terms prepares businesses for scaling, making integration with automated billing systems, accounting software, or ERP systems seamless.

Common Billing Terms Explained

Below is a business billing terminology list covering the common billing terms used in invoicing.

-

Invoice

An Invoice is a formal financial document requesting payment for goods or services delivered. It includes line items, taxes, total amount, due date, and payment terms. Invoices are essential for financial documentation and accounts receivable tracking.

-

Proforma Invoice

A Proforma Invoice is issued before final billing. It provides a price estimate and helps buyers approve costs before payment. It is commonly used in advance payment scenarios.

-

Tax Invoice

A Tax Invoice is a legally required invoice under Goods and Services Tax (GST). It is mandatory for claiming Input Tax Credit (ITC) and supports GST-compliant billing and audit trails.

-

Credit Note

A Credit Note is issued when an invoice amount needs to be reduced due to returns, overbilling, or discounts. It improves billing accuracy and reconciliation.

-

Debit Note

A Debit Note is issued when the original invoice amount was undercharged or additional charges apply. It ensures financial transparency and correct fiscal documentation.

-

Due Date

The Due Date is the deadline for payment. Clearly defined due dates improve cash flow management and reduce overdue invoices.

-

Payment Terms

Payment terms explain how billing terms work in real life. Examples include:

- Net 15

- Net 30

- Advance Payment

Clear payment terms reduce confusion and improve collections.

-

Outstanding Amount

The Outstanding Amount is the unpaid balance on an invoice. Businesses track it using real-time tracking tools in billing software terminology.

-

Billing Cycle

The Billing Cycle defines how often invoices are generated—weekly, monthly, quarterly, or annually. A defined billing cycle improves operational efficiency.

-

Line Items

Line items list individual goods or services on an invoice. They ensure standardized invoicing and help during audits.

Tax and Compliance-Related Billing Terms

Tax and compliance-related billing terms are specialized invoicing terms that ensure businesses follow GST regulations, apply correct tax codes, and maintain audit-ready, legally compliant financial records.

-

GST

GST is a consumption-based tax applied to most goods and services. It is central to billing terms in GST invoicing.

-

CGST, SGST, IGST

CGST: Central GST for intra-state sales

SGST: State GST for intra-state sales

IGST: Integrated GST for inter-state sales

Correct usage ensures regulatory compliance.

-

HSN / SAC Code

HSN Code (for goods) and SAC Code (for services) classify items for tax purposes. Accurate classification is crucial in billing software and accounting software.

-

Input Tax Credit (ITC)

Input Tax Credit (ITC) allows businesses to offset GST paid on purchases against GST collected on sales. Proper billing ensures eligibility.

Payment and Transaction Terms

Payment and transaction terms define how and when payments are made, tracked, and recorded, ensuring smooth cash flow, accurate accounts receivable, and transparent financial transactions.

Mode of Payment

It includes cash, UPI, card, and bank transfer. Multiple payment modes improve customer convenience.

- Part Payment

A Part Payment occurs when a customer pays only part of the invoice. Billing systems adjust balances automatically.

- Advance Payment

An Advance Payment is collected before service delivery and adjusted against the final invoice.

- Late Payment Charges

Late fees encourage timely payments and protect cash flow.

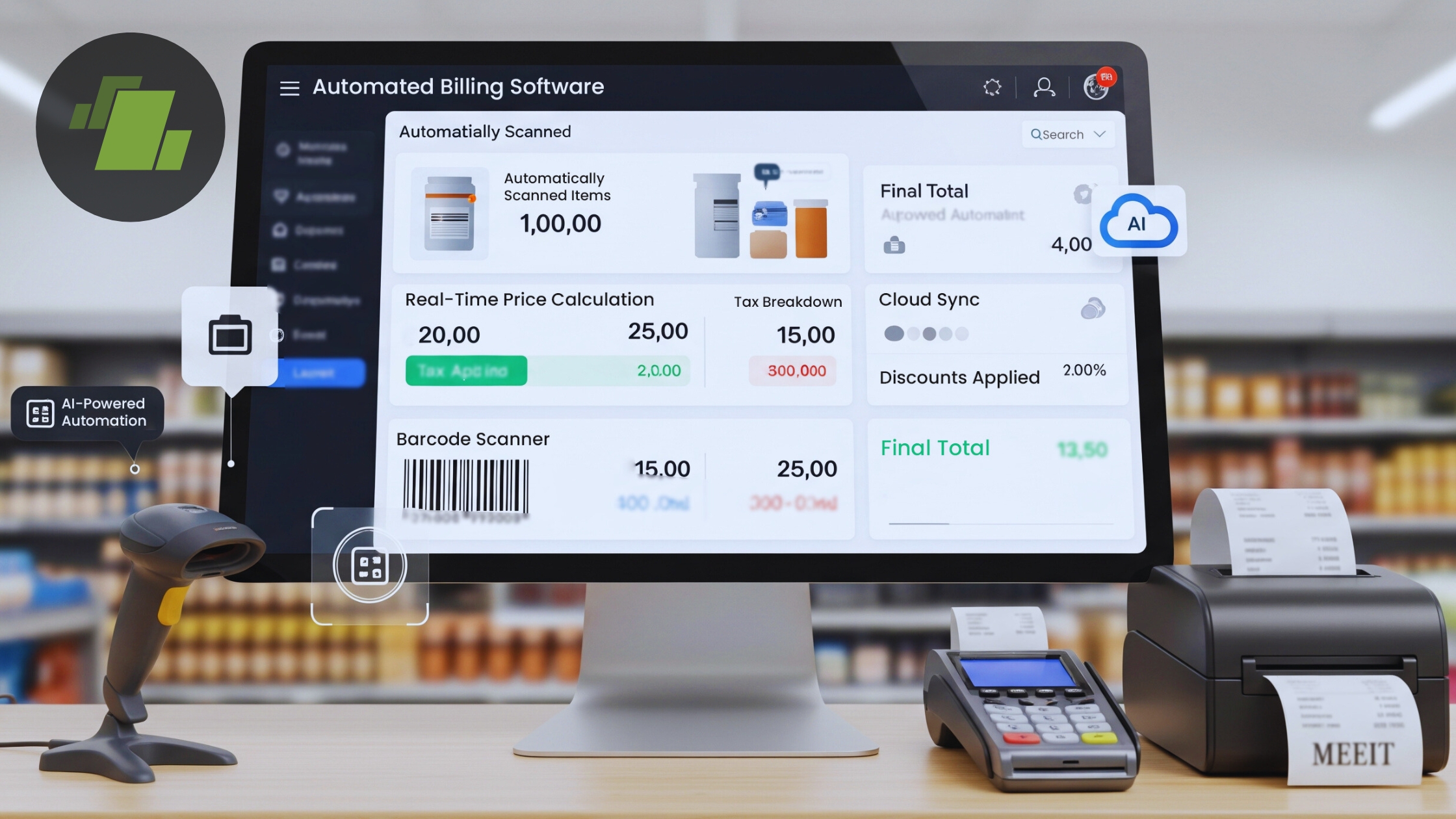

How Our Billing Software Simplifies These Terms

Our modern billing software simplifies these terms, making invoicing and billing processes faster, more accurate, and fully compliant with tax regulations. Here’s how:

1. Automates Calculations and Compliance

Manual calculations for taxes, GST, CGST, SGST, IGST, and Input Tax Credit (ITC) can be error-prone and time-consuming. Our automated billing system ensures every invoice is GST-compliant by automatically calculating taxes, applying correct HSN/SAC codes, and updating totals accurately. By reducing the risk of human error, it ensures billing accuracy, supports audit-ready records, and simplifies regulatory compliance.

2. Reduces Manual Errors

Traditional billing methods often lead to mistakes in line items, payment terms, or due dates, which can cause disputes and delays in accounts receivable. With our billing software terminology integrated into the system, each invoice is automatically validated. This error reduction ensures transactional accuracy, faster payments, and improved cash flow management, helping businesses maintain financial transparency.

3. Improves Reporting and Tracking

Tracking outstanding amounts, part payments, and billing cycles manually can be overwhelming. Our billing software provides real-time tracking, automated reports, and cloud-based dashboards, enabling business owners to monitor invoice management, payment processing, and financial documentation at a glance. This not only streamlines reconciliation but also supports compliance-ready reporting, making audits simpler and more efficient.

Why Every Business Owner Should Use Billing Software

1. Time Savings Through Automation

A cloud-based billing software automates repetitive tasks such as invoice generation, payment reminders, and tax calculations. This reduces manual work, freeing business owners and finance teams to focus on growth. Automation improves invoice management, supports financial documentation, and ensures transactional accuracy without additional effort.

2. Improved Billing Accuracy

Manual invoicing can lead to errors in line items, payment terms, or due dates, which may result in delayed payments or disputes. Billing software terminology and built-in validation features help businesses maintain audit-ready records with standardized invoicing. This not only improves cash flow management but also builds trust with clients by providing precise, error-free invoices.

3. Built-In Tax Compliance

Modern billing software ensures your invoices are GST-compliant and automatically calculates taxes such as CGST, SGST, IGST, along with proper HSN/SAC code classification. It also tracks Input Tax Credit (ITC), helping businesses meet statutory requirements while avoiding penalties. This makes compliance easier and more reliable than manual tax management.

4. Scalable Solutions for Growing Businesses

As businesses expand, manual invoicing and accounting become increasingly difficult to manage. Automated billing systems are designed to scale with your operations, handling larger volumes of transactions, multiple clients, and complex billing structures. This ensures continued operational efficiency and financial transparency, even during rapid growth.

5. Integration with Accounting Software and ERP Systems Using Cloud Computing

Cloud-based billing software seamlessly integrates with accounting software and ERP systems, ensuring all financial data is centralized and accessible in real-time. Integration allows for secure billing, real-time tracking, and simplified reconciliation, improving overall business efficiency. With role-based access and compliance-ready reporting, businesses can maintain control over sensitive financial data while leveraging the advantages of modern technology.

Final Thoughts

Understanding the key billing terms every business owner should know is important for accurate invoicing, regulatory compliance and financial stability. When paired with a reliable billing system, these terms become tools for growth, transparency and efficiency.

If you are looking for the best billing software for your business, contact our experts at +91-73411-41176 or send us an email at sales@logicerp.com to book a free demo today!

Frequently Asked Questions (FAQs)

1. What is the difference between invoice and bill?

An invoice is issued by a business requesting payment, while a bill is often used for immediate payment requests.

2. Are billing terms legally mandatory?

Yes, many billing terms are required to meet statutory requirements and tax regulations.

3. Can billing software manage GST automatically?

Yes, modern billing software handles GST, ITC, and compliance automatically.

4. How do billing terms improve cash flow?

Clear billing terms reduce delays, disputes, and unpaid invoices.

5. What billing terms are used in invoices most often?

Invoice, due date, payment terms, tax invoice, and outstanding amount.

6. Is billing software suitable for small businesses?

Absolutely. It improves accuracy, saves time, and scales as the business grows.

7. Why is it important to understand billing terms explained for beginners?

Learning billing terms explained for beginners reduces mistakes in invoices, improves accounts receivable, speeds up cash flow, and ensures compliance with tax laws like GST, CGST, SGST, and IGST.

8. What are the most common billing terms explained for beginners?

The key billing terms explained for beginners include invoice, proforma invoice, tax invoice, credit note, debit note, due date, payment terms, and billing cycle. Knowing these ensures clear financial documentation and audit-ready records.

9. Why is it important to know invoicing terms and meanings?

Knowing invoicing terms and meanings reduces errors in invoices, speeds up payments, improves accounts receivable, and ensures tax compliance, including GST, CGST, SGST, and IGST.

10. What are billing terms in business?

Billing terms in business are standardized words and definitions used in invoices, bills, and financial documents that explain how payments are requested, tracked, and processed. They ensure that businesses can collect payments accurately, maintain proper accounts, and comply with tax laws like GST. Essentially, billing terms define the rules of invoicing so that both the business and its clients clearly understand the payment process.

Explain billing terms in simple language.

Billing terms may sound technical, but in simple language:

- Invoice: A document asking a customer to pay for goods or services.

- Proforma Invoice: A quote sent before final billing to confirm costs.

- Tax Invoice: A legal invoice including GST, needed for tax purposes.

- Credit Note: Reduces the invoice amount if a product is returned or overbilled.

- Debit Note: Increases the invoice amount if the customer was undercharged.

- Due Date: The deadline for payment.

- Payment Terms: Rules for payment like Net 30 (pay in 30 days) or advance payment.

- Outstanding Amount: Money still owed on an invoice.

- Billing Cycle: How often invoices are sent (weekly, monthly, or annually).

In short, billing terms explain who pays, how much, when, and under what rules. Using these correctly helps businesses maintain billing accuracy, cash flow management, and audit-ready records.

Give billing terms examples.

Here are some practical billing terms examples commonly used in business invoicing:

| Billing Term | Example / Meaning |

|---|---|

| Invoice | A company sells goods worth ₹5,000 and issues an invoice requesting payment. |

| Proforma Invoice | A supplier provides a ₹5,000 estimate to the client before shipping the goods. |

| Tax Invoice | The ₹5,000 invoice includes ₹900 GST and shows HSN codes for compliance. |

| Credit Note | Customer returns ₹1,000 worth of goods; a credit note is issued to reduce the invoice. |

| Debit Note | Additional shipping cost of ₹200 is added; a debit note is issued. |

| Due Date | Payment is due within 30 days of invoice (Net 30). |

| Payment Terms | Net 30, Net 15, or Advance Payment options for flexibility. |

| Outstanding Amount | ₹4,000 still unpaid from the original ₹5,000 invoice. |

| Billing Cycle | Monthly subscription invoices issued on the 1st of every month. |

| GST | Goods and Services Tax of 18% applied on products for compliance. |

Using these billing terms examples helps business owners clearly understand how invoicing works in practice, reducing errors and disputes, and improving financial transparency.